A taper tantrum, but without the taper? Also, big bank mergers and a big mistake

Mergers, regulation, and some more

If you haven’t already, please do subscribe for our weekly newsletter.

Follow us on Twitter: @banking_journal

M&A:

M&T Bank buys People’s United (PBCT) in an all-stock deal valued at $7.6bn

Wells Fargo to sell its asset management division to private-equity firms GTCR and Reverence Capital for $2.1bn

Aviva to sell its French unit for €3.2bn

JPMorgan Chase steps up search for acquisition targets as competition intensifies from fintechs - CFO says the effort is being driven by “perhaps a greater sense of urgency”

Greek bank dumps its €10.8bn toxic loan book, selling it to Davidson Kempner

Fintech Apex Clearing to go public via a SPAC-merger with Northern Star Investment Corp. II

H20 Asset Management hires advisors Perella Weinberg Partners to dispose of illiquid debt at the request of UK regulators

Banking, Insurance & Regulation

Revlon error forces Citi to restate its Q4 earnings, cutting profits by $323mm

JPMorgan exits private banking in Mexico, refers clients to BBVA

Insurance firms urge UK regulators to reduce capital buffers (solvency II) after exiting EU rules

Ant Group boosts capital in consumer finance unit as it prepares to restructure its micro-lending division

Largest European banks to be asked to justify why they’re still clearing euro swaps in London

Bank of America cuts staff in investment banking and trading businesses, after most banks held back job cuts in 2020

Citi rolls out digital-only banking offering in Hong Kong

$116bn-asset bank SVB Financial Group discloses potential fraud on $70M loan - stock drops 2%

Credit markets

S&P raises Deutsche Bank’s credit rating outlook from negative to positive

New Zealand’s sovereign credit rating raised by Standard & Poor’s Global Ratings, lifting its foreign currency rating to AA+ from AA, and its local currency rating to AAA from AA+

Global bonds sell off aggressively in unusual trading day (more on this later)

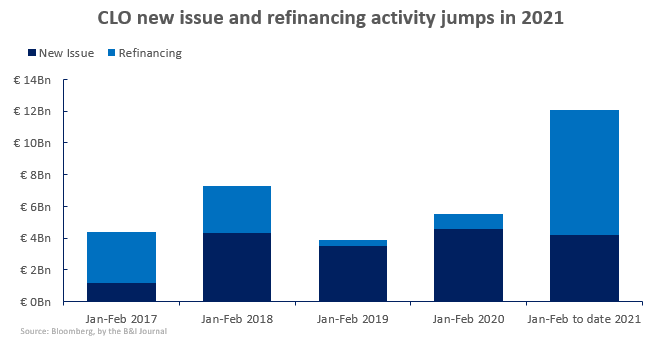

CLO activity in Europe hits record as refi deals boom (more on this later)

Mortgage applications fall by 11% as rates spike, and Texas energy outage hits demand (more on this later)

Economics & Markets

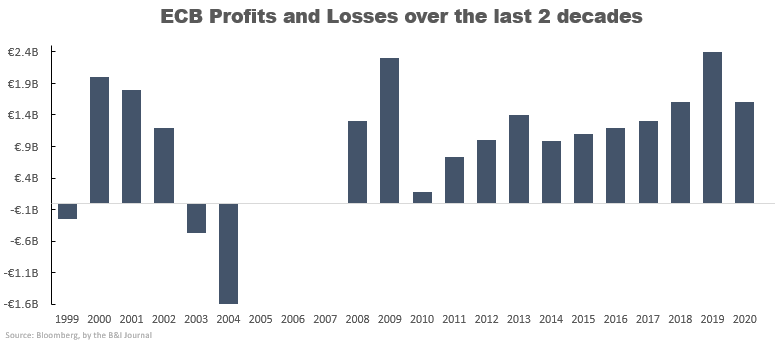

ECB profits dropped in 2020 on USD asset losses and expiry of old bonds

Yuan’s global popularity for payments hits 5 year high of 2.24%; greenback weakened over the last year

ECB concerned bond market sell off - may need to boost support if higher long term yields hurt growth

BoE’s Chief Economist warns against complacency over inflation - saying the risks to inflation “are skewed to the upside, rather than being balanced”, and could overshoot the BoE’s 2% goal for a sustained period of time

Chairman of Australia’s $135bn sovereign wealth fund warns global central banks’ loose monetary policy has inflated a stock market tech bubble, and says that it will eventually lead to a “clean-out” in global equity markets; his fund raised cash balances to 20% in December, up from 17% before

General Market & Economic Observations

U.S. home prices rice 10.4% YoY as housing supplies plummet, and demand grows

New orders continued to rise in January as the manufacturing side of the economy continues to be strong. Core durable goods orders rose 0.5% and durable goods orders rose 4.3% in January. Signaling that business investments in the U.S. continues to grow and remains strong.

In January, personal income shot up by over 10%, as stimulus checks hit the account balances of many. The only thing is, consumer spending did not rise so much, rising just 2.4% in December.

As people spent less in January, despite a huge jump in retail sales, and people saved their stimulus checks, the personal savings rate spiked to the highest since March to 20.5% - signaling low consumer confidence, and this is a big problem if not spent. The expectation is that all these savings are set to be spent en-masse later in the year, after mass vaccinations, and pent up demand from lockdowns will lead to this spending boom, and a spike in inflation.

Bond Markets

Europe’s CLO activity surged in the first two months of the year, as companies rush to catch up on a year’s worth of missed refi activity, leading to record volumes for collateralized loan obligations.

This week was an interesting week in the bond market, where bonds were aggressively sold off on a global scale. Mortgage rates, bond yields spiked on Thursday, before cooling down, and ending the week slightly higher. Stocks sold off as yields spiked. Though the narrative is that it was on inflation fears. Bloomberg says it was not fundamentals based, but technicals based, as traders exited crowded positions, and a huge $50 billion treasury futures position being liquidated.

Biggest stories of the week:

M&T Bank buys People’s United (PBCT)

M&T Bank Corp. agreed to buy People’s United Financial Inc. in an all stock deal valued at $7.6bn.

Pro-foma, the bank will have $200bn in assets, and a 12-state network of 1,100 branches, from Maine to Virginia.

M&T Bank’s CEO, Rene Jones said after the announcement:

“The banking environment is very competitive, and we’re trying to figure out how we can get the necessary scale across things like technology, marketing, and at the same time really continue to make improvements. That takes a fair amount of investment.”

This deal comes after a wave of regional bank mergers over the last few years, as low rates, and little loan demand push banks in the space to consolidate so they don’t lose business to the larger commercial banks, and other industry giants.

The deal will increase M&T Bank’s tangible book value by 0.4%, making it cheaper than Huntington Bancshares’ purchase of TCF, which diluted its book value by 7%.

People’s United investors will receive 0.118 shares of M&T stock for every share owned, putting the acquisition price at about $17.70 per share.

The deal terms:

People’s United investors will own 28% of the combined company, and M&T will own 72%

The transaction is expected to be completed in Q4

The deal will be 10-12% accretive to M&T’s 2023 EPS, reflecting annual cost savings of $330 million

U.S. lenders with ~$250bn in assets are subject to greater regulatory scrutiny, and mergers such as this help them lower compliance costs.

The other largest recent regional bank mergers were:

PNC Financial Services Group agreed to buy Banco Bilbao Vizcaya Argentaria SA (BBVA)’s U.S. banking operations for $11.6bn all-cash - this was the largest deal last year

Huntington Bancshares Inc. bought TCF Financial Corp. for $6bn last December

M&T Bank’s stock is still down 22% from its 2018 highs, and the shares rose 1% after hours on the news

In 2012, M&T was to buy Hudson City Bancorp, but was stopped by regulators, and held up for a number of years after the Federal Reserve investigated M&T’s anti-money—laundering controls. That deal was not approved until 2015. The firm is expected not to have an regulatory problems this time round.

Wells Fargo to sell its asset management unit

In the latest deal in the asset management space, Wells Fargo agreed to sell its asset management unit to private equity firms GTCR and Reverence Capital for $2.1bn .

Wells Fargo’s latest CEO Charlie Scharf vowed to cut costs and boost profits after the 2015 sandal, and turn around the bank’s years of underperformance.

They had pledged to cut $8bn from its annual expenses over the next 3 years, through streamlining its operations around its core businesses, making them more efficient.

The deal will be all-cash, and Wells Fargo will keep a 9.9% stake in the asset management unit, and “continue to serve as an important client and distribution partner”.

Wells Fargo Asset Management (WFAM) has $630bn of client assets, 24 global offices, and employs 450 investment professionals.

A sale of WFAM had been expected since 2019, and JPMorgan was once seen as a possible buyer, who’s CEO, Jamie Dimon, said he was on a hunt for an acquisition.

JPMorgan Chase steps up search for acquisition targets

At a virtual investor conference, JPMorgan’s CFO Jennifer Piepszak said that JPMorgan’s stepping up its search for an acquisition with “perhaps a greater sense of urgency”.

She continued:

“There are businesses like asset management where scale matters even more than it did a year ago. And then other businesses where the need to move quickly and to innovate quickly to keep up with competition is certainly accelerating.”

Jamie Dimon told investors a year ago that he was aggressively looking for acquisitions across its business lines, and that it would buy anything but another US bank.

Since then, one of JPMorgan’s largest investment bank competitors, Morgan Stanley, announced two major deals: buying Eaton Vance, and E*Trade Financial Corp.

In December, Jamie told M&A bankers to call him with ideas, and mentioned that he was particularly interested in the asset management division.

Jennifer Piepszak also mentioned that inflation inflation is “getting a lot of attention - that’s a risk we’re starting to really think about.” and she also mentioned that US consumers are strong due to higher savings rates among their customers.

Insurance firms urge UK regulators to reduce capital buffers (solvency II) after exiting EU rules

The Association of British Insurers (ABI) has urged policy makers to reduce the solvency II capital buffer insurers are required to hold, and to give them more freedom over how they invest their float and assets. Such changes would allow them to reinvest £95bn, with some going to shareholders.

These changes would be the first major divergence from Brussels’ rules since Brexit in the sector.

Huw Evans, director-general of the ABI said these changes would demonstrate the benefits of Brexit, and make up for some of the “significant” expense of preparing for Brexit over the last few years.

He continued:

“We’ve had the costs, now we must seize the opportunity. The opportunity comes in having a Solvency II framework that provides strong policyholder protection - as strong as we had before - but with a set of rules that are designed for the UK market, not for [the EU] 28.”

Looser rules with capital buffers could generate an additional £16.6bn in real GDP annually by 2051, according to KMPG and the ABI, driven by lower financing costs where assets are invested and increased productivity.

The ABI says that the changes would not harm policyholder protection, and could make various products cheaper.

The ABI also asks for simplifying reporting requirements for insurance firms.

Solvency II rules were introduced in 2016 as a way for UK regulations to better work with the EU’s. The regulations were very complicated and took over a decade to negotiate, with extra urgency after 2008.

Revlon error forces Citi to restate its Q4 earnings, cutting profits by $323mm

In August last year, Citigroup Inc. wired $900 million to some hedge funds, by accident. It then asked for the money back, saying something like ‘sorry, it was a mistake, please send us the money back’.

Some did, and some didn’t; they decided to keep it.

So, Citi sued them, and then lost, and they got to keep the money.

Backstory:

In 2016, Revlon Inc. took out a 7 year syndicated term loan, of which Citigroup was the administrative agent - it gets interest and principal payments from Revlon, and passes them onto the lenders.

Revlon then had some trouble with paying it back, and so in May last year, they convinced (sort of) some of the lenders to strip collateral from the term loan so it could be used to pay back new debt, so the lenders who were part of the “incredibly aggressive” deal got rolled into essentially more senior debt; the others were left with the worse debt and were unhappy. So they filed a lawsuit against them.

Then, suddenly, to their luck, 20 hours before they filed it, Citigroup wired them all their money, and received wire transfers for the full amount of principle and accrued interest they were owed.

They thought that Revlon had decided to just pay it back, instead of fight it. But then, the next day, they got a note from Citi saying it was a mistake. Then, the lenders decided to get together, make fun of and mock Citi on Bloomberg chat. Then, they said they are keeping the money, and will see them in court.

Anyway, Citi lost, and the lenders got to keep the money that wasn’t given back, and all in all, Citigroup had to bear the cost of the stupid mistake and write it down from their earnings in a restatement this week.

Today’s other stuff

First of all, this is what’s expected of Rishi Sunak’s budget next week:

Sunak is to announce a £5bn “restart” grant scheme to help the British high street recover from Covid-19 - the grants, worth up to £18,000 each are aimed at shops, pubs and hotels; the services sector. This will take the total spending on this stuff to £25bn over the past year

A corporation tax increase is expected, bringing it up from 19% to about 25%

He’s expected to freeze income tax thresholds - the £12,500 level at which people start paying the 20% rate, and the £50,000 level at which people pay 40%. This would mean 1.6 million people are pushed into a higher tax bracket by the next election

The budget will include details about the UK Infrastructure Bank which will fund the private sector on environmental projects. It will receive £12bn of equity and debt capital, as well as a further £10bn of government guarantees.

Second, I want to talk about the supplementary leverage ratio (SLR)

Last year, the Fed allowed banks subject to the SLR to exclude U.S. Treasury securities and deposits at Federal Reserve banks from the measure, which measures capital relative to assets. The exemptions are set to expire on March 31, but the Fed could still delay that, and has not yet come to a conclusion. The exemptions were meant to free up resources for banks to make loans and other purposes.

Though the Fed has not yet come to a conclusion, Jerome Powell indicated to the Senate Banking Committee this week that an extension is still on the table.

The SLR requires banks with $250+bn in assets to have an extra cushion of high-quality capital against their total assets. The standard level is 3%, but for the larger bank holding companies, that goes up to 5%.

The temporary relief meant allowed banks to expand their balance sheets and prevent stress of the Treasury markets, but reduced the required amount of capital by $76bn.

Democratic lawmakers are not in favor of extending it, suggesting that banks that chose to pay dividends to shareholders “rather than invest in the real economy” should not receive an extension.

The fear is that if regulators choose not to extend the relief, it could result in banks being forced to turn away deposits, cut back on capital returned to shareholders, and reduce reserves.

I’ve been a bit busy recently, so I haven’t been writing long ‘opinion’-ey pieces. So, I hope to get back to doing those from next week.

What we’re reading:

NYT: Stimulus Checks Helped Personal Income Surge in January

Bloomberg: Stop Toasting Powell and Think About Regime Change

Bloomberg: Warren Buffett’s Berkshire Letter Doesn't Take Reddit, Bitcoin Bait

NYT: Daniel Loeb's Third Point Bets on Topeka Sam's Criminal Justice Group

FT: ‘It needs to change its culture’: is McKinsey losing its mystique?

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. I/we may, directly or indirectly, have positions in securities mentioned on this site. I am (/we are) not registered as financial, or investment advisors, or securities broker-dealers with the SEC, FINRA, or any other securities regulatory body. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and their opinion, and do not represent the opinion of those associated with the writer. Use the materials and information presented on this site, and newsletter at your own risk. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.