Aon and Willis agree to divest assets in order to win approval for $35 billion merger

Also: The Chinese Yuan, banks issuing credit cards to people without credit scores, inflation, Ebay and some more.

The Week’s Briefing

M&A

Aon and Willis agree to divest assets in order to win approval for $35 billion merger

Banking, Insurance & Regulation

Largest U.S. banks, including JPMorgan & BofA, plan to issue credit cards to people with no credit scores

Ebay to start offering loans to businesses in the UK

UK Treasury sells additional 580 million shares of NatWest (a 5% stake) for £1.1bn as they continue to slim down stake in the bank, now at 54.8%

The U.S. Justice Department enters into a deferred prosecution agreement with Swiss Life and three of its subsidiaries.

The FCA said it is “formally investigating” the collapse of Greensill Capital, the Serious Fraud Office also said it is investigating Sanjeev Gupta’s businesses and his dealings with Greensill.

JPMorgan ordered to disclose US documents in Nigeria oil case, where they have been accused of enabling $875m in misappropriated payments of state funds.

U.S. audit watchdog, The Public Company Accounting Oversight Board, proposes new framework to help implement new trading ban for companies whose audits haven’t been inspected by American regulators.

Blackrock wins approval to begin operating its wealth management business in China

Goldman Sachs’ Marcus CFO leaves for JPMorgan, as senior Goldman executives continue leaving the bank amid new changes by David Solomon

Insurance group Axa says its Asian operating units have been hit in a ransomware attack, after cyber criminal group claims to have seized large amounts of sensitive data from them.

Wells Fargo bank analyst, Mike Mayo estimates U.S. banks will cut 200,000 jobs over the next decade as they focus on increasing efficiency and profitability

Economics & Markets

The Bank of England boosts short-term GDP growth estimates, while cutting future quarters’ growth estimates

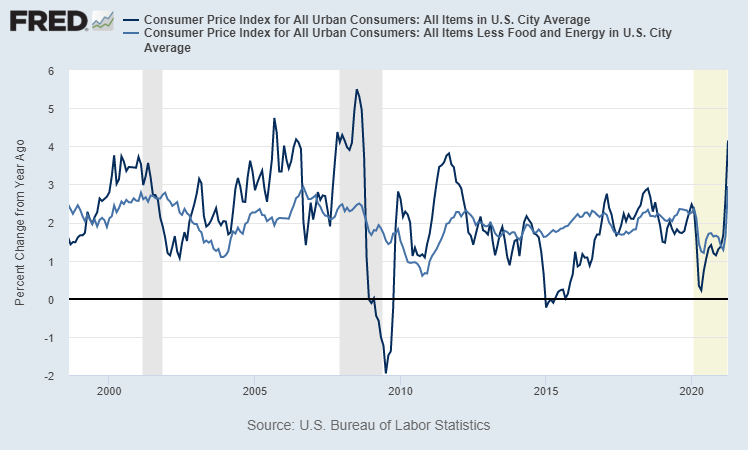

U.S. CPI figures come in higher than expected at 4.2%, and ~3% for core-CPI, the highest since 2008.

While this looks really bad, it isn’t. That’s because last year, the inflation rate fell significantly creating what is called a lower ‘base’ for the reading, meaning that the % change looks greater because it started at a lower number. Really, the CPI (as shown below) just got back to its pre-Covid trend.

Biggest Stories of the Week

Aon and Willis agree to divest assets in order to win approval for $35 billion merger

In March last year, two of the world’s largest insurance brokers Aon & Willis Towers Watson announced a $35 billion merger, but quickly came under anti-trust scrutiny from EU regulators, who feared that the merger would narrow customer choice and give the combined company too much control over prices for assisting clients buy insurance against property and casualty damages, cybercrime and trade tensions.

The combined entity will be named “Aon” and will be head-quartered in London with over $20 billion in annual revenues, and $800 million in cost savings annually as a result of the merger. The combined company will be worth close to $100 billion.

In order to address regulators’ concerns, they agreed to sell a package of assets to a smaller insurance broker, Arthur J. Gallagher in a $3.57 billion deal. The deal is dependent on the Aon-Willis merger transaction completing.

The EU’s anti-trust watchdog said it has not reached a decision on whether to allow the merger to proceed, and will decide by August 3rd.

Largest U.S. banks, including JPMorgan & BofA, plan to issue credit cards to people with no credit scores

The largest banks in the U.S. are working together, with the OCC, on a project called “Project REACh” in an effort to help people who do not have credit ratings from FICO etc. get access to credit cards.

They will utilize people’s deposit-account data (for example, not having any returned checks could improve an applicant’s chance of getting approved) to decide whether or not to issue credit cards to people who do not have credit scores. In the future they plan to consider even an applicant’s history paying rent and utility bills.

Banks may have to contend with concerns regarding customer’s data privacy and transparency in the future, as well as open themselves up to loan losses, which could cause the banks to eventually drop out of the scheme.

For banks, the program will address an issue of social importance and will provide them with a new opportunity for making money. In 2015, a study by the Consumer Financial Protection Bureau found that over 45 million Americans did not have a credit score, because they had never had histories with credit reporting agencies, such as Equifax, as well as because some people’s data is too old to be used.

If some of these consumers are abled to be approved under the scheme, those who demonstrate good borrowing behavior, and credit-worthiness could eventually qualify for auto loans, mortgages and other lucrative products for the banks.

Though there are risks in the program, JPMorgan’s CEO of consumer lending is optimistic, saying that “It’s not a Hail Mary, it’s something that we know works.”

Ebay to start offering loans to businesses in the UK

Ebay said that it will start offering loans to businesses that sell through its marketplace in the UK, as it gets more competitive with high street banks and its former subsidiary PayPal.

Ebay’s UK general manager, Murray Lambell said:

“We think this is a field ripe for innovation and there’s a lot of unmet demand for better service for online businesses, we think eBay is well positioned to deal with this.”

They announced the launch of its ‘Capital for eBay Business Sellers’ program, as a “landmark” move as it moves further into the financial services space.

The CEBS will start offering loans of £500 up to £1 million to its 300,000 SME customers that sell through its platform, in a partnership with online lender, YouLend.

It said that it will announce in coming months its plans for lending to larger companies as well.

Technology companies like Ebay moving into the financial services sector has recently been an increasing concern for high-street banks, as these companies have already established relationships with small businesses and lots of data on them already.

Ebay said that it does not plan to develop its own in-house credit unit, but will rather work with specialists for it.

Their closest competitor (in terms of loan-book size) is not established banks, but PayPal, who has recently aggressively been expanding its loan-book, which currently stands at $2.7 billion.

The U.S. Justice Department enters into a deferred prosecution agreement with Swiss Life and three of its subsidiaries.

The U.S. Justice Department said it has entered into a deferred prosecution agreement with Swiss Life Holding AG ,and three of its subsidiaries (Swiss Life Holding, Swiss Life (Liechtenstein) AG, Swiss Life (Singapore) Pte. and Swiss Life (Luxembourg) SA), who they recently charged with ‘conspiring with U.S. taxpayers and others to hide insurance policies and related policy investment accounts in banks around the world and the income generated in these accounts’.

The deferred prosecution agreement requires Swiss Life and its subsidiaries to refrain from all future criminal conduct, enhance remedial measures, and cooperate with further investigations into hidden insurance policies and related policy investment accounts.

The Swiss Life entities agreed to pay $77.3 million (inclusive of restitution, forfeiture of all gross fees and a penalty). If the Swiss Life entities follow their terms, the DOJ will defer prosecution for three years and then seek to dismiss the charges.

Some other stuff

There are a lot of comments going round that the digital Yuan is a ‘huge threat the USD’s reserve currency status’ and ‘the U.S. needs to move quickly to stop this and that from happening etc. etc.’, well, I don’t think those comments actually mean anything and you shouldn’t be sucked into them (they usually are just said to sound smart, with no reasoning).

So, I recently wrote a thread on Twitter about it, so here’s that thread (just slightly modified) again on why the e-Yuan is no threat to the USD:

1. The Yuan is not freely convertible. It's difficult to use and invest in as a result of strict capital flows & regulation, China has the right to decide what kinds of inflows and outflows are 'good', and 'bad', meaning they can stop outflows whenever they want, e.g. 2016/17.

They call this 'managed convertibility', and prefer to have “discretion” in its management of the capital account.2. It's reliant on the U.S. Dollar. Theoretically, the U.S. could cut off Chinese co/s and banks from access to the USD payment system, which would seriously disrupt China’s investment flows & cross-border trade.

The U.S. also has the power to enforce prohibitions on dealings with states like Iran or with Russian officials because it controls access to the USD. The U.S. can thus pressure financial institutions & co/s that depend on the dominant USD system and fear exclusion from it. They could implement such prohibitions on companies that try to use an e-Yuan to skirt money-laundering regulations and evade U.S. rules.

The Chinese Central Bank is itself one of the largest holders of USD's and a large amount of Chinese debt is issued in dollar.

The digitalization of the Yuan would benefit cross-border trade slightly, but not to a degree that will outweigh other issues.3. The internationalization of the Yuan would not be that good for China. If the Yuan became a reserve currency, foreign demand for it would cause it's value to rise against other currencies, making exports look more expensive to customers hurting sales & economic growth.

Longer term, if growth continued to decline afterwards, the Central Bank of China would need to engage in a monetary policy regime that is more suited to domestic interests; lowering interest rates to encourage spending and borrowing

4. And of course the obvious problem: the CCP. The Chinese government is not transparent enough with the Yuan etc. or trustworthy enough for people to adopt it as a reserve currency.

A BOJ official, Kamiyama, said that, on the topic of a digital Yuan: 'For a currency to become popular it has to be safe, have stable value and be to able moved without restrictions’. We just looked at those requirements, and the Yuan fails all of them.

Why would a digital Yuan change all these problems so quickly, that it will rise from having just a 2% share of global reserves to as much as 80% like the USD? Network-effects don't work in this particular situation if the Yuan goes digital first.

Another key reason is that most governments in the developed world do not want or need a payments platform to monitor all transactions that is controlled by an authoritarian, untrustworthy state like China.

An e-Yuan would not fix these fundamental issues with the Yuan; simply making something ‘digital’ does not fix its problems. Jerome Powell also said that with digital currencies, it is important not to get there first, but do it right.

The people who say that the Yuan is a huge threat to the USD, like Ray Dalio and people on Twitter trying to sound clever, are just wrong, and I hope that this piece by me will help explain why.

What we’re reading

WSJ: Are Fannie and Freddie Ready for the Next Housing Crash? (by Mark Calabria)

Bloomberg: Why Lumber Trader Stinson Dean Says the Great Short Squeeze Is Over

FT: The summer of inflation: will central banks and investors hold their nerve?

WSJ: Companies Are Flush With Cash—and Ready to Pad Shareholder Pockets

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. I/we may, directly or indirectly, have positions in securities mentioned on this site. I am (/we are) not registered as financial, or investment advisors, or securities broker-dealers with the SEC, FINRA, or any other securities regulatory body. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and their opinion, and do not represent the opinion of those associated with the writer. Use the materials and information presented on this site, and newsletter at your own risk. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.