Credit Markets, Banking, ESG Investing, Bitcoin and more

As suspected, it was a busy week this week, with lots of M&A activity and company announcements, and so there are lots of headlines, and some interesting in-depth ones to read.

If you enjoy this post, please do share it with others, and subscribe (if you have not already).

Please read the disclaimer at the end before continuing.

The Week’s Briefing:

M&A

SoFi to go public via $8.7bn SPAC merger with Chamath Palihapitiya’s blank-cheque firm, Social Capital Hedosophia Holdings Corp. V, in a deal that will value them at nearly 9 billion dollars.

US Bancorp to Acquire MUFG Union Bank's $350bn-AUM debt servicing and securities custody services client portfolio.

Associated Banc-Corp is selling its wealth management unit, Whitnell & Co., to Rockefeller Capital Management. The financials of the deal were not disclosed.

SVB Financial Group is to buy Boston Private Financial Holdings, at 115% of TBV, in a $900MM cash and stock deal. Boston Private currently has $16.3bn AUM.

Truist Financial to sell its $10bn institutional 401(k) investment advisory division to OneDigital Investment Advisors. This comes after executives at Truist pledged to cut $1.6bn in annual expenses by the end of 2022.

Insurance company, The Allstate Corporation, has closed its $4bn acquisition of National General Holdings Corp.

CI Financial has completed its acquisitions of 4 Registered Investment Advisor (RIA) firms, boosting its assets to $22bn.

French bank Natixis has agreed to sell its majority stake in H2O Asset Management

Banking, Insurance & Regulation

Wells Fargo & Company said that the Office of the Comptroller of the Currency (OCC) has been released from a consent order, from 2015, related to an anti-money laundering compliance program, after the bank took steps to fix the problems. The consent order was one of 11 public enforcement actions which Wells Fargo was operating under.

JP Morgan Chase & Co. is in talks with China Merchant Bank to establish another joint Chinese venture in wealth management.

Haven, the Amazon-Berkshire-JPMorgan health venture, is to shut next month.

Federal investigators are probing American Express’s business-card sales practices. The U.S. Treasury, and the Federal Deposit Insurance Corp. (FDIC) are investigating whether AmEx used aggressive and misleading tactics to sell cards to business owners - First reported by the WSJ.

After a long investigation, U.K. Watchdog, the Financial Reporting Council, found that Deloitte, and two former partners, failed to challenge Autonomy Corp.’s accounting, a former FTSE 100 enterprise software company, that was acquired by HP in 2011.

Deutsche Bank AG has agreed to pay $125MM to settle criminal allegations (bribing foreign officials and spoofing), in a deferred-prosecution deal. As long as DB doesn’t engage in these activities again over the next 3 years, there will be no prosecution. This comes a year after JP Morgan was fined a record $920MM for spoofing.

BBVA U.S. shuts down its neobank, Simple

Commerzbank will write off €1.5bn in goodwill on its books, and set aside about €630MM euros for bad loans, as Covid-19 strains, once again, on the European economy.

Credit Suisse Group AG has set aside $850MM (on top of $450MM set aside earlier on in the year) to pay fines, and settle other legal action, related to toxic residential MBS’s, as well as other toxic securities they issued prior to 2008. This will lead the bank to book a net-loss in Q4 2020, which was an otherwise strong year.

Economics & Markets

U.S. non-farms payroll miss, with the biggest job loss since April, losing 140,000 in December.

Back end of the U.S. yield curve steepens significantly on the Democrats winning the house and the senate, in anticipation of greater stimulus cheques (and more helicopter money).

30-Year mortgage rates slip to new lows, as FED continues aggressive MBS purchase program.

Long term bonds sell off, with the 10YR reaching the highest yield since March.

Bank stocks rally hard on Biden senate win - the KBW bank index is now nearly back to pre-pandemic levels.

The Bitcoin bubble continues to inflate, with prices topping $40,000

Gold/Silver sell off with the USD strengthening, and real yields reversing (a little).

SoFi Going Public Via SPAC

SoFi (Social Finance Inc.) is a San Fransisco-based startup lender that will go public via merging with Chamath Palihapitiya’s SPAC, Social Capital Hedosophia Holdings Corp. V.

The company began as a student loan refinance business, and has now expanded into mortgages, credit cards, personal loans, insurance, as well as investing and deposit accounts. Their platform currently has over 1.8 million members.

They generated over $200 million in revenues in Q3 2020, and expects total adjusted revenues in 2021 to be $1bn - a YoY growth of 60%. The current CEO is Anthony Noto, a former Twitter executive.

The merger transaction will provide $2.4bn in cash proceeds for the firm, including a private investment in public equity and ~$805MM in cash held in the blank-check company’s trust account.

Chamath Palihapitiya runs a well known VC firm, Social Capital LP. The SPAC is also being run by Ian Osborne, who is CEO of VC firm Hedosophia.

The private part of the investment is being supported by Chamath and Hedosophia, who are contributing $275MM together. The other $950MM is being raised by institutional investors, namely Blackrock, Coatue Management, Altimeter Capital Management, and others.

The U.S. OCC granted SoFi preliminary approval for a national bank charter last October, and when the transaction closes (expected to be in Q1), they epect to direct $150MM to obtaining the charter.

Wells Fargo’s Release From the 2015 Consent Order Enforcement

The consent order was implemented in November 2015, 5 years ago, and was in a response to problems found in Wells Fargo’s wholesale banking unit, with annual sales of $5MM. The OCC found that Wells Fargo’s processes for evaluating whether individual customers posed a money laundering risk, were ineffective.

The order required Wells Fargo to collect certain information about their corporate customers, and their real owners. This had to be in accordance with regulatory guidelines on the beneficial ownership of companies. The OCC recently informed them, that Wells Fargo was found to have satisfied their requirements.

This, however, is still only one of eleven orders that regulators imposed on Wells. Most notably, the asset cap imposed by the Federal Reserve in 2018, which is expected, by company executives, to stay in place until at least late 2021-according to reports by Bloomberg. This is contrary to officials at the FED, who expect it to be a much longer period till the asset cap is lifted.

U.S. Bancorp Buys a Large Custody Book from MUFG Union Bank

The Minneapolis based bank, U.S. Bancorp, has agreed to buy a debt servicing and securities portfolio from MUFG Union Bank. This portfolio has about $320bn of AUM.

US Bancorp already provides custodial and admin services for $7.7T of assets for global clients, for example, hedge funds.

The deal will bring in 600 new clients, and will raise the company’s profile on the West Coast, where MUFG is based, and operates as part of a Japanese financial company, Mitsubishi UFJ Financial Group - who bailed out Morgan Stanley by investing $9bn in equity, for a 21% interest in the company on a fully diluted basis, in 2008. That 2008 deal was $3bn in stock, and $6bn of perpetual non-cumulative convertible preferred stock with a 10 percent dividend.

The deal is expected to close in the first quarter, upon regulatory approval.

Amazon-Berkshire-JPMorgan Health Venture to Shut Next Month

Three years ago, Amazon, JP Morgan and Berkshire Hathaway started Haven, in an attempt to overhaul employee health care. The venture is now set to shut, next month.

At the time it was launched, the announcement sent shockwaves through the U.S. health industry, as Haven planned to lower high costs, and fix notorious inefficiencies and poor customer service.

Despite the venture shutting, the three companies will continue to collaborate informally, and work together on programs for their combines 1.1 million employees.

Amazon, however, does not plan to back out of the health care industry, after in bought PillPack LLC in 2018 for $735MM, and even at the beginning of the pandemic, the company formed its own laboratories and tested its own employees.

Jamie Dimon said in a memo to employees that: “Haven worked best as an incubator of ideas, a place to pilot, test and learn -- and a way to share best practices across our companies, our learnings have been invaluable.” JP Morgan, and the other two companies, will still work to place Haven in their own companies.

JP Morgan is in Talks with China Merchants Bank on a possible Wealth Management Venture

JP Morgan plans to establish another joint-Chinese venture in wealth management, as global banks rush to capture a piece of the growing market, set to worth over $30 trillion by 2023.

The preliminary talks with China Merchants Bank are to set up an entity, expanding their strategic partnership on products in 2019 (according to people familiar with the discussions). While the talks are ongoing, JP Morgan is unlikely to have control in this venture, according to those people.

The plan is subject to change, and the talks could still fall apart.

JP Morgan already has mojority ownership of a mutual fund management venture, China International Fund Management, and plans to pay at least $1 billion to buy them out (the remaining 49%). A new partnership with China Merchants Bank (the nations largest bank, and known as the "king of retail banking,") would boost JP Morgan’s client base and distribution network, significantly. Under new regulations last year, foreign firms can take full control over their joint mutual fund ventures in China.

The Shenzhen based Merchants Bank had over 155 million retail clients at the end of September, and over $1.3 trillion (8.6 trillion yuan) in AUM - with its private banking clients assets grew 19% to 2.7T yuan in the first 3 quarters of last year.

The opening of China’s $53 trillion financial industry has led global banks, such as JP Morgan, UBS Group and Goldman Sachs Group to expand their footprint there, adding staff, and expanding into everything from asset management to futures and brokers. However, the wealth management sector is set to grow the most, and is expected to double over the next few years. This will be a prime focus for foreign FI’s.

Ray Dalio, famously known for being very bullish on China as a country, said that 2020 was a “defining year” for financial markets in China, and said that “China already has the world’s second largest capital markets, and I think they will eventually vie for having the world’s financial centre.”

Investing in China, of course, carries significant political risks, underscored by the suspension of Ant Group’s planned IPO last year.

Jamie Dimon said that JPM is committed to bringing its "full force" to China, and increased its Chinese securities joint venture to 71% from 51%, and has gained full control of a futures unit in China.

General Market & Economic Observations:

Economic summary:

The manufacturing side of the economy held strong last year, with PMI’s and New orders growing, but the labour market came under stress, as the country faces a resurgence in Covid-19 cases, losing 140,000 jobs in December, led by the Leisure and Hospitality industry. Nonfarm payrolls missed estimates significantly, which came in at -140k against the consensus estimate of +50k, for the December period.

As you can see below, the labor market has lost a lot of its momentum, and this was its first net job loss since April, ending a multi-month streak of gains. The industrial side of the economy has, however, faired much better with the Manufacturing PMI coming in at 60.7, and a strong rebound on new durable goods orders.

As we all now know, after a tumultuous week, the Democrats formally won the Senate, leading the credit markets to price in more future stimulus and helicopter money. This led to long term bonds selling off, hard, on inflation fears, and the 10Y yield reaching its highest since the lockdowns at the start of the pandemic. The breakeven rates (yield spread between treasury bonds and TIPS) hit the highest since 2018.

The equity markets continued to rally, with the S&P starting 2021 on a high note, and high yield bonds rallying hard (as seen in the chart below) have left HY bond yields near the lowest levels ever, almost as if the pandemic and recession never happened, and no bankruptcies will appear. This is clear evidence of euphoria in the markets.

The same is evident in the investment grade credit markets, which Bill Ackman said, post vaccine news, that he had taken a small position in, as a hedge against a virus resurgence toiling the markets.

The yield curve has steepened significantly after the Biden win, contrary to 2019 where the curve was inverted (signalling chances of a possible recession last year).

One a short note this week, I would like to talk a little about ESG investing, and Bitcoin (after a number of people contacted me asking me about it) - two recently very popular market trends.

Firstly, Bitcoin has no inherent value. It is purely speculative, and in my opinion, a bubble waiting to burst. It is simply a number on a computer that can’t even be used for very much, payments wise. Neither is it diverse, the price of a single bitcoin is now nearly double the annual wage. The top 2.8% of all Bitcoin addresses, control 95% of the supply, and more than 63% hasn’t been moved for the past year (according to recent estimates). This has made the already speculative ‘asset’/currency, Bitcoin even more risky due to it being incredibly illiquid, as a result of the low available supply. This explains its moves of often double digit percentage points per day - up, or down. Therefore, the idea that you can simply exit your position whenever you want, is not realistic. Just last week on Saturday, someone selling just 150 coins caused Bitcoin to fall 10% (according to a tweet reported on by the FT). No-one is there to take the other side of the trade. This means that when people start selling, you’re in for a serious ride. According to a report by Bloomberg, more than 2000 wallets hold over 1000 coins. Imagine what could happen if just one decided to dump their position. There are also regulatory risks, where regulators could destroy Bitcoin, should they want to do so, as well as the fact that the illiquidity and the notion of “HODLing” has led to it not being able to be used as a payments system, aside from other problems with the payments side. If you ask a single Bitcoin bull to give just three fundamental reasons why it should go up, other than printing money, and it being “decentralized” (totally false), I can bet that they couldn’t give even one, except that it has gone up in the past, and should continue to do so in the future, simply because of the greater fool theory. It has proved zero correlation with inflation, monetary policy and real yields - unlike Gold, and other assets. It’s a fun to dance to the music here whilst the music is still playing, but when it stops, there likely won’t be a chair for you sit at.

Now, moving on to the notion of “ESG investing” and the problem with issuing ESG bonds. First of all, a lot of people seem to forget that “ESG” has three components, not just the environment:

1) Environmental

2) Social

3) [Corporate] Governance

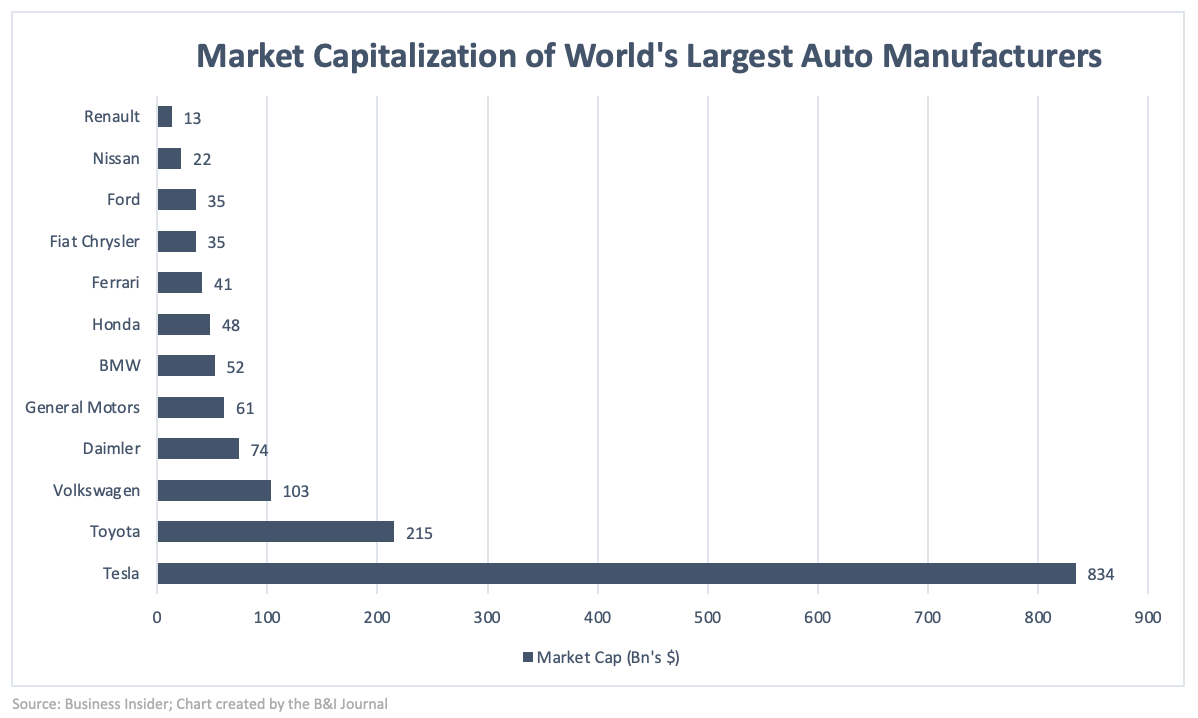

Now, if you look at a lot of so-called “ESG-friendly” companies, they focus solely on the environment - this is the main thing. There is then, occasionally, some Social, and near to no corporate governance. In fact, the rise in investors appetite for these ESG-related companies has led to many instances of fraud, bubbly and lots of “story” stocks, a number have gone public via SPAC, e.g. Nikola (accused of being a fraud, and demonstrably bad CG). Then there’s Nio, Tesla, Next Era Energy, and more. Here’s a chart to think about, this is Tesla’s market cap compared to the other largest global car manufacturers:

The “ESG-friendly” notion is also being exploited, where some companies can in Europe, essentially, borrow money from the ECB at low or negative rates, if they make themselves look all “ESG”. The idea of “ESG-friendly” [investing] is skin-deep and superficial.

One last thing is that I want to talk a small amount about stimulus. In a press conference, President-elect, Joe Biden, said:

“It will be in the trillions of dollars, the entire package . . . in order to keep the economy from collapsing this year, getting much, much worse, we should be investing significant amounts of money right now to grow the economy.”

I would like to say here, that whilst stimulus is needed, it is not needed to such a great extent. As I have said before, printing trillions will lead to a net-harm position in the long run. The need for this much stimulus is a humanitarian one, not an economic one - and here, I have to say, Joe Biden is wrong.

The Biden administration also poses other risks to markets, with tax hike and more regulation for big-tech (recently the biggest out-performer in the market). According to a report by Bloomberg, the big 6 U.S. banks could face more than $11bn in tax hikes, in 2022, assuming Biden reverses the highly accretive Trump administration tax-cuts.

Some other things:

I would recommend reading this incredibly informative article by Jeremy Grantham about the current market conditions:

https://www.gmo.com/europe/research-library/waiting-for-the-last-dance/

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. You should not construe any such information as financial, investment or any other advice. I/we may, directly or indirectly, have an economical interest (positions) in securities, and/or related securities, mentioned on this site. Investing in equities and securities carries risks, and I am/we are not liable for any possible loss, or risks you take, you are solely responsible for the risks you undertake. You are solely responsible for any investment decisions you choose to make. You should do your own research and due diligence, and/or consult with a registered financial advisor, and/or broker-dealer, and/or investment advisor before making any investments in securities or investment decisions. If you choose to make any investment decisions without consulting and/or seeking advice from any such registered advisor, then any consequences, as a result, are your own, and sole, responsibility. I am (/we are) not registered as a financial, or investment advisor, or securities broker-dealer with the Securities and Exchange Commission, FINRA, or any other securities regulatory body or authority. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and his/their opinion, and do not represent the opinion of those associated with the writer, in a personal or professional capacity. Use the materials and information presented on this site, and newsletter at your own risk. Any views or opinions are not intended to malign any institution, organization, company or individual. Materials and information on this site should not be relied upon for investment advice or to make investment decisions. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.