David Swensen, Yale's endowment chief dies aged 67

Also: AmEx, the Fed, the Blue Cross Blue Shield Association and payments processing

The Week’s Briefing

M&A

Citi’s Australian retail banking unit has drawn interest from a number of the Australia’s largest banks

American Express Global Business Travel is to acquire Expedia’s corporate-travel arm and enter into ‘long-term partnership’ between them

Banking, Insurance & Regulation

Bank of America says cyber-crime has surged recently and will deploy more resources to fight it

The Blue Cross Blue Shield Association said it has dropped its revenue rule that limited competition among its members

Federal Reserve looks into allowing Fintechs with “novel types of banking charters” to access accounts and services provided by the Fed

Citi looks into launching crypto services after crypto client interest surges

Goldman Sachs launches Bitcoin derivatives unit

Yale endowment chief David Swensen dies aged 67

Goldman Sachs to bring US and UK bankers back to office in June

Largest US banks have asked large corporate clients to put cash into money market funds rather than in deposits to avoid having to hold more capital due to regulatory rules

Europe’s largest banks plan joint attack on US payments giants

Warren Buffett and Charlie Munger said that Greg Abel will take over Berkshire after Warren Buffett

SEC Chief raises concern about market influence of Citadel Securities

Economics & Markets

US non-farm payrolls for April came in at 266,000, nearly 800,000 below consensus expectations of over 1 million; unemployment rate rose to 6.1%, expectations were for it to fall to 5.8%

Most hiring was in the leisure and hospitality sector which was hit hardest by lockdowns last year, that hiring picked up, although hiring in other parts of the economy slowed or had large numbers of people being laid off.

Federal Reserve’s financial stability report warned that their current measures of hedge fund leverage “may not be capturing important risks” - pointing to the Archegos collapse as an example.

Biggest Stories of the Week

Federal Reserve looks into allowing Fintechs with “novel types of banking charters” to access accounts and services provided by the Fed

The Federal Reserve is deciding whether it should give fintechs more direct access to its payment system as the fintech space continues growing rapidly.

Fintech startups have to rely on relationships with traditional banks that have accounts with regional Fed banks to use the Fed’s payment systems. This would allow them to sidestep that. Even when fintechs have been granted access from the Office of the Comptroller of the Currency, their access is usually limited to an extent.

It proposed guidelines that would allow fintechs with “novel types of banking charters” to access accounts and services that the Fed provides.

The Fed said that the new rules would require potential fintechs to demonstrate an ability to comply with their strict orders and policies, and be in “sound financial condition” by maintaining adequate capital.

CEO of the American Bankers Association said that any candidate should be held to the same high standards as any other current bank with access to such Fed accounts:

“To access the system today, banks must meet the highest regulatory standards and face rigorous oversight,

Every entity seeking similar access to the Fed’s payments system, including those with novel charters, should meet those same high standards. To do otherwise would put consumers and the financial system at risk.

American Express Global Business Travel is to acquire Expedia’s corporate-travel arm and enter into ‘long-term partnership’ between them

American Express Global Business Travel, a joint venture that is partly owned by American Express, said that it is to acquire Egencia, Expedia Group’s corporate-travel arm.

Expedia will become a shareholder in AmEx Global Business Travel and enter into a long-term partnership with them.

The financial terms of the deal were undisclosed.

Arine Gorin, President of Expedia Business Services said:

“Expedia Group strongly believes in the robust return of travel, including in the corporate space,

We’re excited about our potential ownership in GBT and our long-term arrangement to power Egencia and GBT, as we do for thousands of other travel companies.”

As consumer spending and the travel sector recovers from the pandemic, payment companies have been making deals betting on that recovery.

The Blue Cross Blue Shield Association said it has dropped its revenue rule that limited competition among its members

The Blue Cross Blue Shield Association is a federation of 35 separate health insurance companies that hold exclusive rights to Blue Cross and Blue Shield brands in certain territories in the US. They provide services to over 100 million people.

The BCSA said that it dropped a rule that limited competition among its member insurers as part of an almost-approved anti-trust settlement the companies reached last year with its customers.

The BCSA will lift a cap on the share of revenues that could come from businesses not under a Blue Cross Blue Shield brand. The rule previously was that two thirds of a BCSA insurance member’s annual net-revenue must come from a Blue-branded business.

Anthem and Health Care Service Corp. are some of the largest Blue insurers.

The anti-trust claims were first brought up in 2012 as a class action on behalf od policy holders with Blue coverage. The suit alleged that the insurers illegally conspired to divide up markets and share them among themselves to avoid competing against one another, which impacted customer’s prices.

The settlement won preliminary approval from a US District Judge, and requires the insurers to pay $2.7 billion to customers and drop the national revenue cap. The settlement, however, has not won official approval from a judge, so isn’t being fully implemented.

30 of Europe’s largest banks and credit card processors plan to create a payments processor to rival the “oligopoly” in the space of PayPal, Mastercard, Visa, Apple and Google

Europe’s largest banks, including Deutsche Bank, BNP Paribas, ING, UniCredit and Santander, have come together with the backing of the European Commission and financial regulators to “build a European payment champion that can take on PayPal, Mastercard, Visa, Google and Apple,”

The pan-European payments service is supposed to be used to pay online, in-store, withdraw cash at ATMs and settle bills between individuals and consumers.

The European Payment Initiative (EPI) has received €30m in funding from its backers and currently employs 40 payments experts. The EPI is still in the early stages, and is still looking for a brand name.

The first part of the EPI’s payments system - used for electronic real-time payments - could be launched in 2022 and the second part - a broader payments tool - could launch after, in the back half of 2022.

A Bundesbank board member said that Germany’s central bank supported the initiative as it “would strengthen the strategic autonomy of the EU in the payments market, enhance competition and thus improve consumer choice”. The ECB has also shown support for it.

Currently, 4 in 5 transactions in Europe are handled by Mastercard and Visa alone, according to EuroCommerce, and the Bundesbank has warned that it could harm consumers and merchants with high fees and data protection. The EPI will “offer an alternative to this oligopoly and give merchants and consumers in Europe a real choice,”

This is also not the first attempt by the EU to challenge Mastercard and Visa, in 2011 the “Monnet Project” was launched, and failed because it could not develop a viable business model.

For the payments processing space, there are very high barriers to entry, as it can only work if large numbers of merchants and consumers use them, as well as the fact that they rely on very close relationships and deals with large banks, for example Chase and Barclays will often issue Visa debit cards, or Mastercard credit cards, that is what helps build those moats.

Some other stuff:

David Swensen, Yale’s endowment chief died aged 67 this week after battling with cancer for a long time. At his time at Yale he became one of the all-time-greats of the money management industry, among the leagues of Warren Buffett and Peter Lynch, just without the fame.

“The really great painters are the ones that change how other people paint, like Picasso. David Swensen changed how everyone who is serious about investing thinks about investing,

The results were wonderful, but were organized to be no surprise, if you watch a great chef prepare in the kitchen, you know the meal is going to be good.”

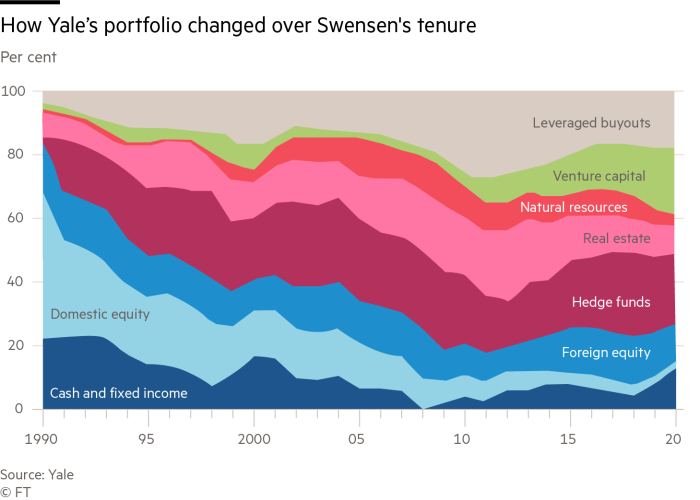

Swenson took over Yale’s endowment in 1985, with an endowment of $1.3 billion, invested in a classic 60/40 portfolio of US equities and bonds.

That changed under Swenson, in 2020, just 2.25% of its portfolio was in US equities, yet still compounded at ~12.5% for 3 decades. He pioneered allocating large amounts of capital for such a fund in more aggressive strategies, allocating capital mostly to LBO funds, private equity funds, venture capital and hedge funds. The endowment now has $32 billion AUM and has made regular disbursements to the university.

There is no doubt that he radically changed the investment landscape, much like Warren Buffett, only Swenson did it with a base salary of just $850,000 and a modest bonus of a few million on top.

There were obviously some problems with this strategy, the fact that a lot of it was invested in illiquid investments caused problems in 2008, forcing Yale and other universities to borrow money, and hedge funds have found it difficult to generate alpha over the past decade due to the rise of passive investing.

Swenson follows two ‘simple’ rules:

1) That equities were a much better investment than bonds or cash for the longer term - and that “equities” should not be restricted just to shares traded on public exchanges but should include any investment with a non-guaranteed upside for the investor.

2) Diversification

He wrote a must-read book on portfolio management called “Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment, Fully Revised and Updated” - which I highly recommend you read.

All-in-all, Swenson was a legend who changed the investing world permanently, and will be remembered as such. Endowments round the world have, and will continue to, learn from. His number one lesson though that we can all learn from was that, and as basic as it seems, over the long-run, with discipline, investing in “equities” will always beat cash and bonds.

What we’re reading

NYT: Why a Shortage Has Made Computer Chips the New Toilet Paper

Bloomberg: April Jobs Report Is a Big Disappointment. What Happened?

Bloomberg: Hong Kong's Incentives to Lure Private Equity Miss the Point

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. I/we may, directly or indirectly, have positions in securities mentioned on this site. I am (/we are) not registered as financial, or investment advisors, or securities broker-dealers with the SEC, FINRA, or any other securities regulatory body. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and their opinion, and do not represent the opinion of those associated with the writer. Use the materials and information presented on this site, and newsletter at your own risk. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.