I’m sure you’re all sick of hearing about r/wallstreetbets, Gamestop, AMC Entertainment Holdings, etc. etc., so you may be happy to hear that I will not be talking about them as the financial world is made up of a lot more than just that topic.

Follow us on Twitter: @banking_journal

Please read the disclaimer at the end before continuing

The Week’s Briefing:

M&A

London Stock Exchange Group completes Refinitiv deal

Allstate to sell life insurance unit to Blackstone for $2.8Bn

Atlanta-based, Ameris Bancorp sold 25 underperforming hotel loans for $87.5 million at 82 cents on the dollar.

Perella Weinberg Partners LP’s Middle East banking team left to start its own advisory firm in Dubai

Banking, Insurance & Regulation

Biggest story of the week: JPMorgan to launch UK retail banking services with a digital-only launch

Leon Black steps down as Apollo’s CEO after Epstein scandal - will remain on the board of directors.

UBS Group AG plans to repurchase $4.5Bn of stock over the next 3 years after solid performance in 2020, with their profits at the highest since the GFC.

Point72 and Citadel inject $2.75Bn of capital into Melvin Capital, run by a protégé of Steven Cohen

Deutsche Bank investigates alleged mis-selling of investment banking products to clients

Mastercard increases fees for UK purchases from the EU

Creditors of struggling Chinese conglomerate, HNA Group applied for bankruptcy proceedings after a court said the company was unable to pay its debts.

BBVA to launch share buyback program (repurchasing 10% of outstanding shares) and resume dividend payments after reporting Q4 profits of €1.32Bn.

Commerzbank to cut one in three jobs in Germany and halve branch network by 2024 in restructuring plan launched by new CEO, Manfred Knof.

Prudential to demerge US business, focusing on their Asia business, and raise up to $3bn of equity - after pressure from activist investor, Dan Loeb at Third Point LLC.

Former U.S. Bancorp CEO, John Grundhofer, dies at 82 - he turned around a struggling Minneapolis bank into one of the largest banks in the country.

Robinhood raises $1 billion in emergency capital injection from investors after clearing houses raise collateral requirements for extremely volatile stocks, such as GME.

2020 Executive Pay

Wells Fargo Chief Charles Scharf, was paid $20.3 million, down 12% from before.

Morgan Stanley Chief, James Gorman was paid $33 million for 2020, up 22% from $23 million in 2019, after a record year in 2020.

Goldman Sachs CEO, David Soloman was paid $17.5 million for 2020, with his salary slashed by 30% over the 1MDB scandal.

JP Morgan Chase CEO, Jamie Dimon’s 2020 salary was held flat at $31.5 million, after strong 2020 performance.

Economics & Markets

U.S. GDP grew a weaker-than-expected 4% in the fourth quarter (exp. 4.2%).

Bank stocks slide on the back of worse-than-expected Q4 GDP and generally weak economic data.

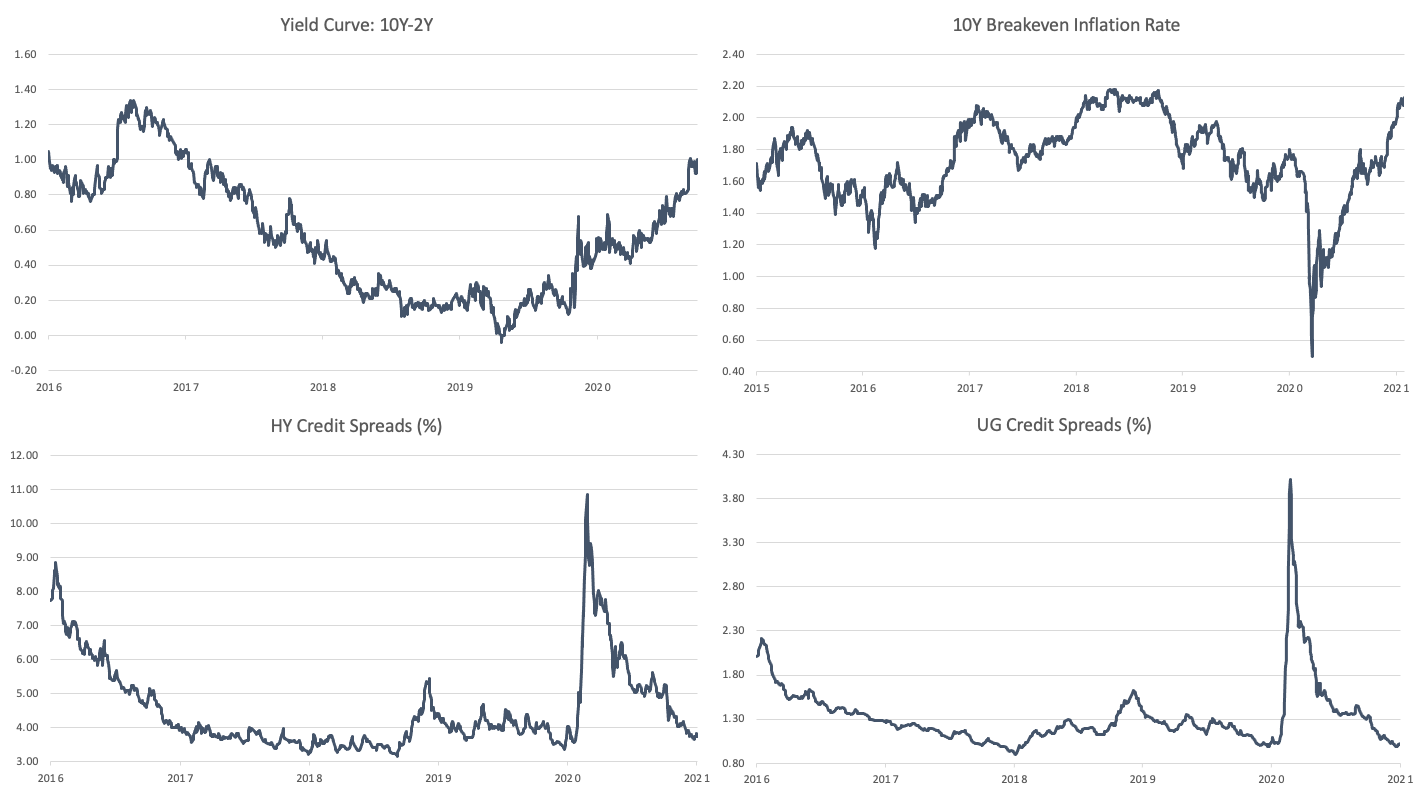

U.S. 10-year yields fall on weak economic data, and continued virus pressure on the economy.

Jerome Powell makes it clear that there will be no bond tapering for “some time”, and will maintain its current bond-buying program at $120 billion of purchases/month until “substantial further progress” toward its employment and inflation goals.

Central bank adviser warns of equity asset bubble in China

S&P Global says that global debt issuance is to dip to $8 trillion in 2021

Global debt rose by $19.7 trillion in 2020

ECB Governing Council member, Olli Rehn says the European Central Bank is ready to use all tools necessary to stimulate inflation, and will keep an eye on Euro’s recent appreciation. Other of her colleagues at the GC have raised possibilities of cutting interest rates (yes, again) in a bid to spur inflation.

Dow falls 3.3%, closing below $30k, S&P 500 falls 3%, and the Nasdaq falls 4.5%

Biggest stories of the week:

JPMorgan Chase & Co. to launch UK digital-only retail bank

After much speculation, JPMorgan confirmed that they will enter the U.K. digital-only retail banking sector, and is set to start opening for business this year.

The bank will operate under the Chase brand, after their last foray in digital (U.S.) retail banking failed, which they say was partially due to them not using the Chase brand, but instead operating under a different, unheard-of name, ‘Finn’.

Jamie Dimon on a call in response to a question about their failed digital bank, Finn:

“We learned a lot, like how to do digital account openings only digital, because when you do it out of a retail bank, you tend to rely on what you already have,”

“You can open a Chase account now and never go into a branch.”

The bank currently serves nearly half of all U.S. households across all banking needs, including deposit accounts, credit cards, home loans and auto lending.

This makes JPMorgan the second big-U.S. bank to enter U.K. retail banking, with the first being Goldman Sachs, which launched a digital savings bank in 2018 operating under the brand ‘Marcus’.

The bank will be led by Sanoke Viswanathan, previously chief administrative officer and head of strategy in the corporate and investment bank.

However, JPMorgan’s plans are much bigger and more ambitious than Marcus. JPMorgan will not offer only savings accounts, but they will start with checking accounts, with the hopes to later expand into higher margin businesses such as credit cards, mortgages and auto loans.

JPMorgan’s co-president, Daniel Pinto, said:

“Our decision to launch a digital retail bank in the UK is a milestone, introducing British consumers to our retail products for the first time. This new endeavour underscores our commitment to a country where we have deep roots, thousands of employees and offices established for over 160 years.”

The U.K. digital bank is a crowded market, with the leader being Starling and Monzo. Although, I can personally say that these banks are not particularly good, from what I have seen, and don’t seem well-developed and, quite frankly, even safe. I suppose JPMorgan being a multi-trillion dollar, reputable bank, it does make you feel much safer with them handling your money.

Jamie Dimon has previously said:

“It doesn’t make sense to do normal retail banking overseas”

But changed his tone last year, where he said, with technology, it could make it more appealing.

JPMorgan is known for boasting an annual $6+ billion annual technology budget, which they hope will lower costs and boost margins in the U.K., giving an advantage over established British banks such as Barclays and HSBC.

The launch in the U.K. is just the beginning of JPMorgan’s ambitions to become a global, tech-oriented bank, where, should it work, they will use it as a model and guide to expand elsewhere in Europe and into other countries.

Former chairman of Lloyds Bank, ex-Citi executive and the UK’s audit regulator, Win Bischoff, joined JPMorgan’s board for the project. He was previously chairman of JPMorgan’s European holding company, and will be head of the board risk committee.

Clive Adamson, previously a senior official at the Financial Conduct Authority, will chair the new bankn.

Along with appointments of a number of other well-experience, long standing JPMorgan executives, and employment of hundreds of people, it shows the scale of the bank’s dedication to their new venture.

JPMorgan has said that the new Chase-branded bank will operate on a different technology platform to their U.S. business, and they have subsequently hired a number of engineers from British digital banks such as Revolut, Monzo, and Starling.

They have already hired more than 400 people who are currently working on the new digital bank, and are set to hire a great deal more.

Gordon Smith, JPMorgan’s chief of consumer and community banking, said:

“The UK has a vibrant and highly competitive consumer banking marketplace, which is why we’ve designed the bank from scratch to specifically meet the needs of customers here.”

“We want to provide customers with a new banking choice, one that will enable them to benefit from a simple and exceptional banking experience, built on the significant capabilities of JPMorgan Chase,”

Deutsche Bank investigates alleged mis-selling of investment banking products to clients

Deutsche Bank is investigating whether its staff mis-sold complex and sophisticated investment banking products to clients, in breach of EU rules - and then colluded with employees of these companies to share the profits.

After numerous customer complaints last year, an internal probe was triggered, initially focusing on a desk in Spain, which sells swaps, derivatives, hedges, and other complex financial products.

The audit found that the bank had wrongly categorised client firms under Markets in Financial Instruments Directive (Mifid) rules. Mifid rules require banks to separate their clients by levels of financial ‘sophistication’, such as retail investor, professional investor or counterparty (institution).

They believe that employees knowingly sold unsuitable products to clients who may not have been able to understand them. The bank is not just investigating a few cases, but it appears to be a broader pattern of this misconduct across the bank, going on for a number of years.

The internal probe is also looking into allegations that there was collusion between the bank’s employees and staff at some of the clients who bought the inappropriate products, and then splitting profits.

Basically, some bankers there were selling products to clients who didn’t understand them and made a lot of money doing so, should they buy them. The products were so bad that the clients who didn’t understand them wouldn’t be allowed to buy them, and no-one who understood what they were would buy them, so they just sell them to the unsophisticated ones instead, and act as though they are sophisticated.

Then, the other side of the same story is that the products are too bad to sell to any client, so you bribe some people who work on behalf of the clients, and sell it to them instead, then split the profits. This basically signals that those clients were sophisticated enough to understand that they were bad products, and wouldn’t knowingly buy them because they’re so crappy.

Prudential to demerge U.S. business and raise up to $3bn of equity

Prudential is to demerge its U.S. business, breaking up the 173-year old life insurer, raising $3Bn of new equity and pivoting its business to Asia.

In 2020, Q1 Dan Loeb at Third Point said that they had amassed a $2Bn stake in the insurance firm (about 5% of the company) and sent a letter to the management team highlighting most of the changes needed.

Prudential said that they had decided to demerge Jackson, their U.S. unit, directly to shareholders rather than go through an IPO of the business.

They will retain a 20% stake in Jackson, and will use the equity offering proceeds to pay down the company’s debt.

In 2019, Prudential demerged M&G, their U.K. insurance unit, in a bid to move much of the company’s business to Asia, which has higher margins and is much more profitable.

Following the split, Prudenntial will remain U.K. head quartered, but will operate its business in Africa and Asia under LSE and Hong Kong-listed shares.

Prudential shares fell 8% on the news.

General Market & Economic Observations

Economic summary:

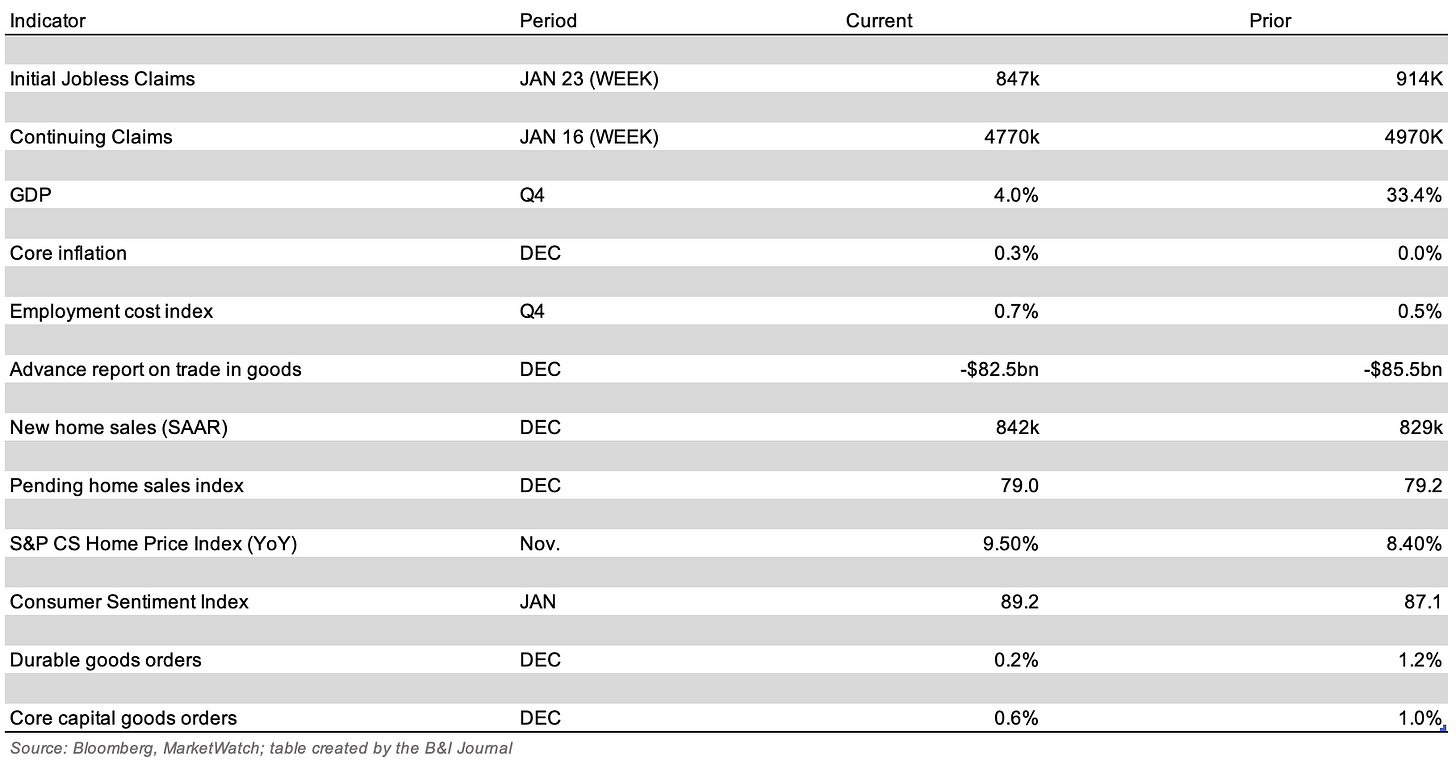

Jobs market slightly recover, although, as you can see below, is still higher relative to history - currently sitting higher than the peak in 2008.

Q4 GDP came in pretty weak, with the economy expanding at just 4% in Q4, due to a delay in stimulus and a resurgence in Covid cases.

Housing markets update:

Credit Markets Update:

Today’s Discussion:

First of all, I would like to say (and I know I said I wouldn’t) that I saw “Silversqueeze” trending on Twitter, where a bunch of people on Reddit are attempting to take down JPMorgan Chase & Co. (a multi-trillion dollar bank) because some people/fund whatever at the firm has a short position on the metal - this is just hilarious, will undoubtedly fail, and is just incredibly funny. There are literally too many problems with that than I can explain - not to mention that their commodity trading desks will likely make a lot of money from it, anyway, so you’re just helping “the suits”. This story about the JPMorgan-silver short squeeze has been going on for decades, and uninformed people are back to regurgitating this nonsense. It simply won’t work.

Second of all, I just want to lay out what the Biden Administration’s banking agenda is:

Pass a stimulus relief bill, to the tune of $1.9 trillion

Determine their next steps for housing reform; i.e. the Fannie Mae and Freddie Mac problem - getting them privatised, which ex-Treasury Secretary Mnuchin failed to do (we’ll be discussing this one today)

Determine next steps for the Consumer Financial Protection Bureau (CFPB)

Next steps for the Office of the Comptroller of the Currency (OCC)

Finish appointments for the Treasury and bank regulators

Housing Reform

If you don’t know about Fannie and Freddie, they are the two largest, multi-trillion dollar U.S. mortgage guarantors that collapsed in 2008, and were bailed out by the Obama administration’s Treasury - where they essentially took control of the companies and essentially took all the companies earnings in a “net worth sweep” (which many people are arguing was illegal, such as Bill Ackman’s Pershing Square, the largest individual commons shareholder of Fannie Mae, as well as a large shareholder of Freddie Mac) - a lot more complicated than that, but we’ll leave it there - I’ll explain what happened with them later in the post.

So, what’s been going on now.

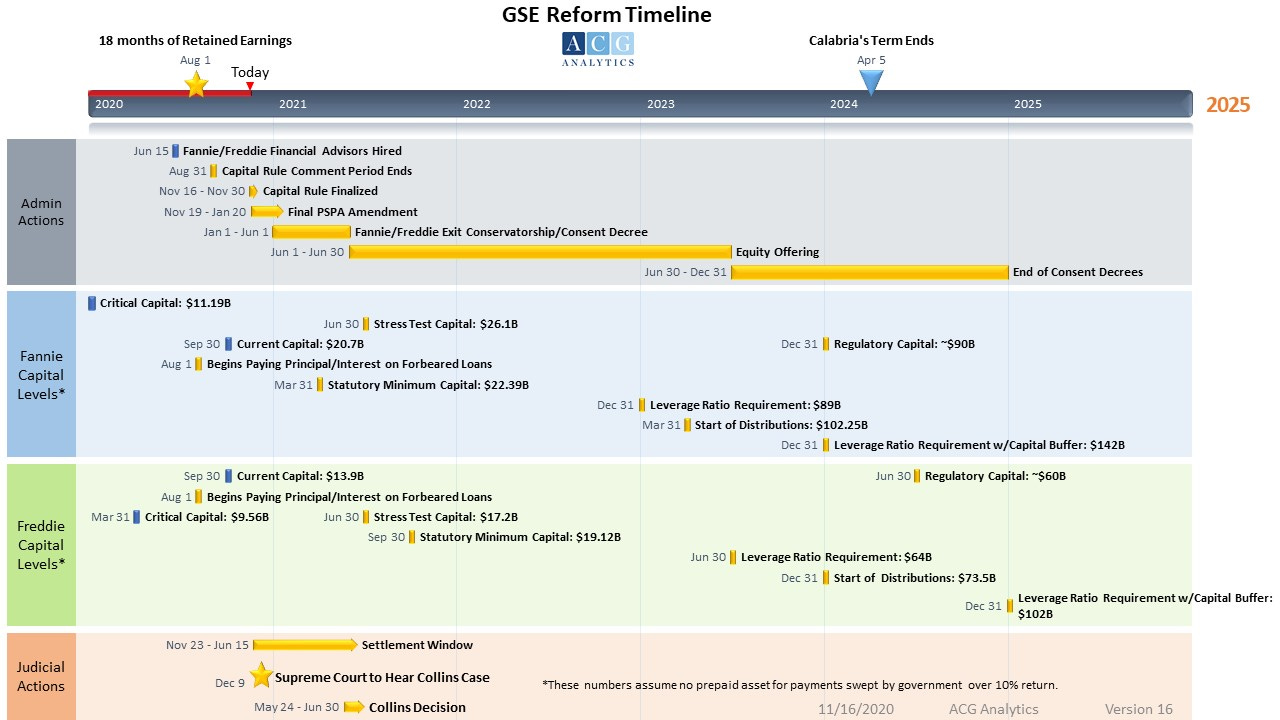

The Trump administration made a number of steps towards releasing them from government conservatorship, which they entered in 2008, and as he did not get a second term in office, they were unable to complete it, and so left the future of Fannie and Freddie in the hands of the Biden administration - who is against privatisation.

The Biden administration will be charged with much of the unfinished business that Mnuchin was unable to complete, including potentially restructuring the government’s ownership in the government-sponsored enterprises (GSE’s).

The U.S. Treasury Department and the Federal Housing Finance Agency (FHFA) moved last week to allow the two GSE’s to retain significantly more of their earnings until the GSE’s can align themselves with a post-conservatorship capital framework finalized in November. However, Mnuchin and FHFA Director Mark Calabria failed to reach an agreement on how to resolve the Treasury’s stake in the companies, making it difficult for the GSEs to build outside capital - potentially through the largest ever IPO - they are multi-trillion dollar asset companies, backstopping roughly $5 trillion of U.S. mortgages.

The Biden administration will decide whether they want to go forward with Mnuchin’s plan, or whether they should move in a different direction.

Many Democratic lawmakers want to transform Fannie and Freddie into government utilities.

The Supreme Court is expected to rule on a case this spring on the leadership structure of the FHFA and the legality of an agreement that at one time required Fannie and Freddie to deliver nearly all their profits to the Treasury - which funds, such as Pershing Square, are saying is illegal.

Biden has hinted that he may fire Mark Calabria, although cannot simply be fired by Joe Biden unless for cause, and he does not answer to a board - although the Supreme Court may rule against this employment agreement in the future.

What happened in 2008

The firms collapsed with the housing market due to them not holding enough capital to backstop the mortgages they guaranteed. The Treasury bailed them out, injecting $187.5Bn of capital, in return for a new class of senior preferred equity, that originally paid a 10% dividend, along with warrants to acquire nearly 80% of the companies’ common stock.

Since then, there have been several amendments to the PSPA’s, most significantly in 2012, when the original 10% dividend on the senior preferred equity was replaced with a sweep of nearly all of the companies’ profits to the Treasury. Owners of the commons, many hedge funds, then sued the Treasury saying this was illegal - the Treasury has already been paid back the bail out money, and then some.

Recently, Fannie and Freddie’s regulator, the FHFA, and the Treasury have raised the amount of capital the companies can hold in their buffers, a limit which had been capped at a combined $45Bn, eliminating the profit sweep.

Fannie Mae and Freddie Mac can’t exit government conservatorship until litigation is resolved, and they build common equity capital tier 1 capital of at least 3% of their assets.

The companies will be allowed to issue new common stock, which they have to to raise the capital to end conservatorship, but only after the Treasury exercises its warrants to acquire nearly 80% of the companies and all the litigation is resolved.

So what now?

To raise that capital, it could take years, maybe even decades, but Mark is optimistic that they can exit it sooner - this is the current release timeline, which they need to follow to exit conservatorship in the next few years:

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. You should not construe any such information as financial, investment or any other advice. I/we may, directly or indirectly, have an economical interest (positions) in securities, and/or related securities, mentioned on this site. Investing in equities and securities carries risks, and I am/we are not liable for any possible loss, or risks you take, you are solely responsible for the risks you undertake. You are solely responsible for any investment decisions you choose to make. You should do your own research and due diligence, and/or consult with a registered financial advisor, and/or broker-dealer, and/or investment advisor before making any investments in securities or investment decisions. If you choose to make any investment decisions without consulting and/or seeking advice from any such registered advisor, then any consequences, as a result, are your own, and sole, responsibility. I am (/we are) not registered as a financial, or investment advisor, or securities broker-dealer with the Securities and Exchange Commission, FINRA, or any other securities regulatory body or authority. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and his/their opinion, and do not represent the opinion of those associated with the writer, in a personal or professional capacity. Use the materials and information presented on this site, and newsletter at your own risk. Any views or opinions are not intended to malign any institution, organization, company or individual. Materials and information on this site should not be relied upon for investment advice or to make investment decisions. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.