FCA proposes “quick fixes” for Mifid rules in UK for small companies

Also: Ares launches a new debt fund, Fidelity expands its securities lending platform, Moody's on the economy, and Deutsche Bank + money laundering

The Week’s Briefing

M&A

Insurer NN looks to sell €300bn asset management unit

Morgan Stanley’s China partner explored sale of its stakes in ventures

Banking, Insurance & Regulation

Standard Chartered to close half of its branches and cut office space by a third

Ares raises €11bn private debt fund

Fidelity launches platform for fund managers to profit from short-sellers

Euronext to pull trading servers out of UK after Borsa Italiana deal

Danish prosecutors drop all criminal charges against Danske Bank chiefs

The Investment Association trade body seeks abolition of taxes on UK funds

FCA proposes “quick fixes” for Mifid rules in UK for small companies

BaFin finds faults with Deutsche Bank’s control mechanisms

FCA vows to loosen SPAC rules

UK insurers sign up for flexible-working plan

Deutsche Bank reports highest quarterly profit since 2014 as IB earnings surge

Barclays’ Q1 profit almost triples on stronger IB; stock falls 7%

Biggest Stories of the Week

BaFin finds faults with Deutsche Bank’s control mechanisms

Germany’s financial watchdog BaFin has ordered Deutsche Bank to fix its anti-money laundering controls, and has extended the mandate of KPMG (which it appointed as special representative in Sep 2018) by as much as 36 months to monitor DB’s progress on tightening up its internal controls.

Deutsche Bank said it has “significantly improved” its controls, and has spent €2bn on it over the past two years, with 1,600 employees globally to fight financial crime. They said that they will “continue to invest heavily in 2021 and beyond, especially into the fight against financial crime”.

Deutsche Bank has had numerous problems related to money laundering over the past few years, and so this is not the first time they have been told to tighten internal controls about it.

FCA proposes “quick fixes” for Mifid rules in UK for small companies

The FCA has proposed a number of “quick fixes” to strict, unpopular Mifid II rules that cover investment research and reporting requirements for equity trading to ensure that asset managers are not at a disadvantage to their competitors in the EU.

Ironically, the FCA was a key architect in shaping and writing the strict Mifid II ruless before it left the EU, but since leaving has pledged that the UK will not be a “rule taker” from Brussels post-Brexit.

The FCA said:

“Our proposals aim to reduce burdens on investment firms while having regard to growth and the competitiveness of UK financial services,”

Mifid II rules currently require asset managers to split the cost of buying research from any trading costs related to the securities. This was supposed to prevent investment banks and brokers from offering research to institutional investors trying to induce them into directing trading orders to them.

Under the FCA’s new proposals, research on small and medium sized small cap stocks with a market cap of less than £200MM will no longer be subject to the “inducement” rules. The FCA’s new proposals also apply to currencies and commodities.

Since the rules were put in place, spending on research for these small companies fell 20 to 30%, raising concerns that smaller companies may find it difficult to raise capital if there is little research on the companies, as no one really wants to pay for research for companies these small.

Nearly 80% of companies with a market cap below £250MM have no research, or one analyst covering them.

Fidelity launches platform for fund managers to profit from short-sellers

Fidelity Investments said it is launching a platform for fund managers that are looking to lend out their holdings to other investors, often being short-sellers.

In a low-rate, low yield world, lending out securities has become an important source of extra revenue, with relatively low risk, for fund managers, providing extra returns.

Fidelity launched its securities lending business in 2019, initially serving just Fidelity’s own funds. It is now extending that service to asset managers. Fidelity Agency Lending now has 90 employees.

Fidelity’s Justin Aldridge, who heads the unit, said:

“With pressures on fees and returns, securities lending is a nice way to generate low-risk returns for your shareholders,”

As a lending agent, Fidelity keeps a share of the revenues generated by securities lending on its platform. Lending out a large-cap stock might boost a fund’s return by 0.01% to 0.02%. Lending out less-liquid equities, particularly those in high demand, might add 0.25% to 0.30%, said Fidelity. 2-3 bps might not be that much, but in a zero-rate world, that’s better than nothing.

Fidelity’s key competitors here is Goldman Sachs. IHS Markit said that industry wide securities lending revenue has grown over the past decade, and by 2018 had exceeded $10bn. Annual revenue totaled $9.3bn in 2020, down 7% YoY, as low interest rates was a drag on loan income.

Ares raises €11bn private debt fund

Ares has raised €11 billion for one of the world’s largest private debt funds, as these lightly regulated alternative lenders (shadow banks) step up their attempt to take share from traditional banks in the bond space.

This fund will be the largest in Europe and will make direct loans to mid-sized companies in the Europe that need an alternative to the usually cheaper funding methods of bank loans and bond markets.

Since the 2008 GFC, shadow banks and private equity groups have steadily taken share from investment banks, due to their lower regulation compared to banks, curbing risky lending from the traditional banking sector.

Jamie Dimon warned of the risks in the shadow banking sector in his 2020 investor letter, highlighting the differences in regulation between banks and “non-banks”.

“While some of this may have been deliberate, sometimes the rules were accidentally calibrated to move risk in an unintended way. We should remember that the quantum of risk may not have changed – it just got moved to a less-regulated environment “ - Jamie Dimon

Ares’ new fund will have total capital of appoximately €15bn because they plan to use leverage to increase fund returns.

Ares’ last European direct lending fund raised €6.5bn in 2018, and has generated net returns of 5.8 per cent as of December 31 on an unlevered basis.

Some other stuff

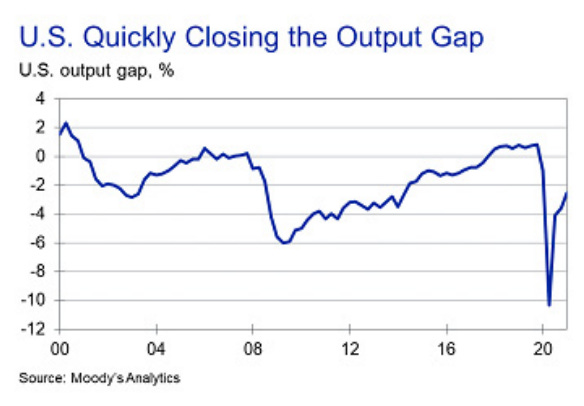

In a research report, Moody’s highlighted how a strong fiscal and monetary policy response to the pandemic in the U.S. has affected the economy compared to 2008.

The output gap in the U.S. should have fully closed in Q2, unlike in 2008 where it took a number of years to close the gap between potential GDP, pre-crisis, and actual GDP.

Moody’s expects a very strong recovery, globally:

“U.S. real GDP rose 6.4% at an annualized rate in the first quarter, a little lighter than our forecast for a 7.1% gain. The economy is about to close the output gap, a small milestone on the road to fully recovering from the recession. The output gap, or the difference between actual GDP and potential output as a share of GDP, was - 2.5% in the first quarter of this year. The output gap could close in the next quarter or two. This is a rapid closing of the output gap, which was -10% in the teeth of the recession. Aggressive fiscal and monetary policy stimulus played a critical role

Though economic impact payments will fade, consumers are sitting on an enormous amount of savings that will decline as restrictions continue to be relaxed. The amount of saving that households have done since the pandemic began, using the Bureau of Economic Analysis measure of saving, compared with what would have been saved at pre-pandemic saving rates, suggests excess saving of about $1.6 trillion as of the end of last year and probably well over $2 trillion today given two rounds of stimulus checks distributed this year. We will update our estimate of excess savings Friday after the release of March personal income.”

What we’re reading

NYT: Here's President Biden's Infrastructure and Families Plan, in One Chart

Bloomberg: How Ratings Agencies Ignored China Debt Risks Over Huarong

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. I/we may, directly or indirectly, have positions in securities mentioned on this site. I am (/we are) not registered as financial, or investment advisors, or securities broker-dealers with the SEC, FINRA, or any other securities regulatory body. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and their opinion, and do not represent the opinion of those associated with the writer. Use the materials and information presented on this site, and newsletter at your own risk. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.