If you haven’t already, please do subscribe for our weekly newsletter.

Follow us on Twitter: @banking_journal

The Week’s Briefing

M&A

Aviva sells Italy unit to Allianz for $1.1bn

P&C insurance fintech Hippo to go public via $5bn SPAC merger

KPMG sells restructuring unit to HIG Capital for £400 million

Banking, Insurance & Regulation

Greensill Capital prepares to file for insolvency soon, after the firm collapses in a dramatic week

Walmart poaches top Goldman Sachs bankers for their new fintech

FCA says new Libor contracts to finish on December 31 for sterling, euro, Swiss franc and Japanese yen

AIG stock surges on rumors of Berkshire Hathaway purchases

Hang Seng Index overhauls Hong Kong’s stock benchmark

JPMorgan looking to sub-let large blocks of office space in two Manhattan towers

Contactless payment limit lifted to £100 in the UK

Moody’s lays out optimistic forecast for European reinsurance firms

London Stock Exchange Group’s stock plunges 14% on Friday after Refinitiv integration costs are much higher than expected

Capital One board adds Facebook and Nike executives to board in new diversity and branding push

Economics & Markets

Broad equity indexes sell off globally as investors rotate out of high-growth tech names into the ‘reflation’ trade.

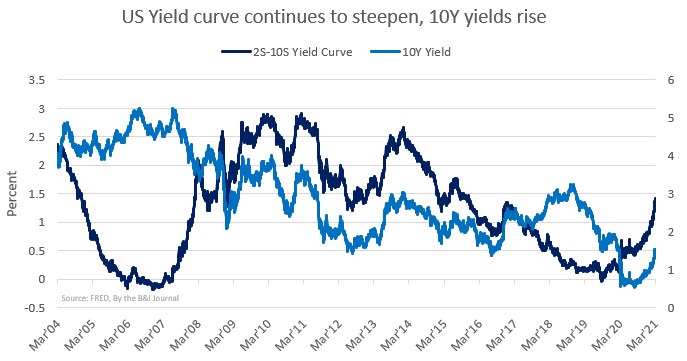

The 10-year yield continues rise as the treasury sell-off accelerates - the 2s-10s yield curve steepens to the highest spread since 2017. It’s worth noting however that traders are aggressively short treasuries

China expects economy to grow at least 6% in 2021

US temporarily lifts trade tariffs on £550 million worth of UK exports.

General Market & Economic Observations

US adds 379,000 jobs in February; unemployment rate drops to 6.2%. It’s important however to keep this number in context, and that is that employment is still much lower than it was pre-Covid in February, let alone how much lower it is now than the pre-Covid jobs potential of February.

More insight into this week’s economic indicators can be found on Bloomberg here: Charting the Global Economy: Surge in Savings to Power Recovery

Today’s other thing

What effect does inflation have on insurance firms?

As the reflation trade gets under way, insurance firms and banks have rallied hard, and are the new momentum play on the street. But, the general consensus that “higher inflation = higher interest rates = more earnings for insurers and banks” is wrong.

I will talk about banks probably next week, and focus on insurance companies today.

First of all, you have to understand how insurers makes money. They have two main lines of business 1) underwriting policies (where the firm assesses the insurance risk/price and then does the contract) 2) they collect premiums 3) they invest those premiums, called the “float” - this money technically does not belong to them, it is the money they would have to pay out in case of losses, and they can invest it generally anywhere, but usually in T-bills, long term treasuries, various fixed income assets and a smaller equity portfolio.

So, how does higher inflation effect insurers?

I’ll start with something AIG’s former-CEO said in 2011, he said that inflation was a bigger risk to insurance businesses than tsunamis, Earthquakes or Europe’s sovereign debt crisis.

Anyway, let’s start with Property & Casualty insurers (P&C):

A huge cost inflation wise from them is the negative impact on the cost of future claims on currency policies. This sounds complicated, so we’ll go through it. Take for example a property insurer. The value of the insured properties are based on the cost to repair/replace them now, when they underwrote the policy. As inflation increases, so does the cost of that property. But, as most policies do not include a pre-specified or fixed value, the cost of claims on that property increase - meaning, the insurer is paid less now to insure a property that will be worth more in the future, and likely won’t be made up by premiums paid, which are often linked to a fixed benchmark that generally does change according to CPI, but is not 1:1 correlated, and may not increase enough to match the increase in property value.

With auto-insurance, the price of new parts to repair vehicles increases significantly in inflationary periods, as the materials to make up those parts increase in price. This can lead to collision damage repair costs rising faster than the CPI rate, and thus the cost to auto P&C insurers is greater.

Then, during periods of high inflation through history, equity prices have declined significantly (although, for some reason, pundits on for example CNBC today seem to think high inflation is now good for the stock market? Anyway). So, insurance firms equity portfolio declines in value, and as interest rates rise, their fixed income holdings lose value, as bond prices and interest rates are inversely correlated (i.e., higher bonds prices = lower interest rate, and vice versa). Although, accounting rules do not require insurance firms to value bonds that are expected to be held to maturity (often, longer term bonds are not held to maturity) at a lower rate, despite the actual economical value of the bond decreasing. During periods 1933-1981, insurance firms’ investment returns were negatively correlated with inflation, but not during 1977-2006, where rates were in a constant downtrend (as they still are now), and generally lower inflation.

Summary: if inflation were to significate pick up, as many seem to think, insurance firms’ (predominantly P&C insurers, less so for life insurers) underwriting and investment returns would be significantly impacted and would cost them a fairly large amount. Although, deflationary periods are not exactly amazing for insurers. Both serious deflationary (I might talk about that another time) and inflationary periods both are bad for insurance firms.

Biggest Stories of the Week

Greensill

Greensill Capital set to file for insolvency soon as company collapses in dramatic week after Credit Suisse froze $10 billion of their funds, meaning they couldn’t package, securitize and sell-off their loans, and thus couldn’t do any new business.

I really do encourage you to read this series - it’s very interesting.

I would love to write more on this, but the authors at the Financial Times have done a great job writing a number of articles in a series on the Greensill Capital collapse here - the most interesting of them all was this one.

P&C insurance fintech Hippo to go public via $5bn SPAC merger

In this week’s SPAC merger, a 6-years-old home insurance start-up Hippo is going public via a merger with Reinvent Technology Partners ZRTPZ.

Reinvent Technology’s co-directrs are LinkedIn co-founder Reid Hoffman, and Zynga founder, Mark Pincus.

To quantify risk in homes, Hippo’s online underwriting tech uses aerial imagery to look at roof conditions and uses building permits to find details of home features, among other things.

They intend to differentiate themselves by pushing insurance services that can help owners avoid claims, such as free water-sensor devices to detect leaks and discounted burglar-alarm systems.

Hippo expects to have $1.2 billion in cash after the transaction, including $550 million of PIPE fundraising from investors such as Dragoneer Investment Group, Ribbit Capital, Lennar Corp., and various mutual funds.

Aviva sells Italy unit to Allianz for $1.1bn, and pays down £800m of debt

One of Europe’s largest insurers Aviva will sell the remainder of its Italian business, and use the proceeds to pay down £800mm of debt, in an effort to streamline its business and strengthen its balance sheet.

Aviva reported its FY2020 results this week, reporting net profits of £2.9bn, up from £2.7bn the previous year.

Aviva’s Solvency II ratio was 202% in 2020 - they said they would consider returning excess capital to shareholders when their Solvency II was above 180%. Their leverage ratio was at 31%.

Allianz and CNP Assurances will buy Aviva’s Italian operations for €873m in cash, with CNP taking over its life insurance operations, and Allianz buying its general insurance business. The total cash generated for Aviva through this deal is €1.3b in cash.

Analysts at Citi expect Aviva to announce a £3bn share repurchase program at the end of 2020, and are optimistic about its business.

Moody’s lays out optimistic forecast for European reinsurance firms

Analysts at Moody’s laid out a broadly optimistic forecast for Europe’s largest reinsurance firms in 2021.

In 2020, Europe’s largest reinsurers, Hannover Re, Munich Re, SCOR and Swiss Re had an aggregate 61% decline in net income YoY.

Their earnings were heavily weighed down by pandemic-related business interruption (BI) and event cancellations, which was not good for their P&C underwriting businesses, as well as rising mortality claims in their life insurance units.

Lower interest rates further weighed on their earnings, as they saw a significant decline in investment returns for the year.

Moody’s analysts also noted that reinsurers have accounted for the large share of BI losses, in both their P&C and life-insurance businesses, as well as on an “incurred but not reported” (INBR) basis.

Most insurance contracts now have clauses to shield them from potential future pandemics, limiting future losses from events like Covid-19.

Moody’s also noted that insurers benefitted from price increases and better T&C in recent policy renewals.

Despite risks of underwriting results not improving and persistently low yields, Moody’s is still optimistic that the latest contract roll-overs, on top of price increases, will generate stronger price momentum in 2021 that will boost their underwriting performance.

At the moment, reinsurance prices remain far below the prices they reached during the last strong reinsurance market in 2012 to 2013, but Moody’s is optimistic that as prices grow, so too will reinsurance firms earnings in the future.

Contactless payment limit lifted to £100 in the UK

Chancellor Rishi Sunak recently announced that the government will raise the legal limit on contactless car payments from £45 to £100 to make shopping easier and boost high street retailers, who’s earnings suffered in 2020.

He presented this as a Brexit win, as the UK no longer has to follow EU limits on contactless transactions.

There are a number of concerns that a) card fraud could increase and b) it could hurt poorer people who rely heavily on cash.

The new limit is not too high by global ex-EU standards, where the contactless limit is about the same/higher:

Australia: AUS$200 (£112)

Canada: CN$250 (£143)

United States: $200 (£145)

A majority of concerns are about the country moving to a cashless society, where many vulnerable, poorer people who rely on cash, will be left behind. The treasury address this issue and said that they are committed to “protecting access to cash”, by making changes such as allowing cashback to be offered at shops without people having to make a purchase (this is one of the proposals).

The changes will come into legal affect on Wednesday, but will not be implemented until later this year when banks and retailers have improved systems in place.

What we’re reading:

American Banker: The national debt is big and getting bigger. Does it matter?

Bloomberg: Inflation Fears Mount Despite Yellen, Powell Calm

NYT: Making Sense of Elevated Stock Market Prices (by Robert J. Shiller)

American Banker: CRE lenders’ growing fear: Office workers won’t come back

Bloomberg: Powell’s Dashboard Shows How Far U.S. Economy Has to Go on Jobs

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. I/we may, directly or indirectly, have positions in securities mentioned on this site. I am (/we are) not registered as financial, or investment advisors, or securities broker-dealers with the SEC, FINRA, or any other securities regulatory body. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and their opinion, and do not represent the opinion of those associated with the writer. Use the materials and information presented on this site, and newsletter at your own risk. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.