More Credit Suisse

Also: ESG funds & the SEC, Walmart, Food delivery companies, JPMorgan and Jamie Dimon's 2020 letter to shareholders

Follow us on Twitter @banking_journal

The Week’s Briefing

M&A

Credit Suisse explores selling scandal-ridden asset-management unit; Reuters cites Allianz and Blackrock as potential buyers - could fetch as much as $4bn

BofA buys health care tech company Axia in health care payments push

Banking, Insurance and Regulation

UK insurance broker Ardonagh launches asset management unit

Credit Suisse’s Risk Chief and other senior executivesto leave, and CS slashes dividend after Greensill, Archegos losses

Walmart files for trademark for ‘Hazel by Walmart’, its Fintech unit

JPMorgan reaches deal with Instacart for their new credit cards, Doordash may be next

SEC review finds some investment managers potentially mislead investors over ESG practices in their funds

Asset manager Axa IM Alts raises €800MM to invest in offices and residential real estate in Europe, focusing on the UK, Germany and France

Credit Suisse prime brokerage unit tightens hedge fund/family office lending limits

US Senate banking chair questions banks over Archegos Capital collapse

Justice Department looks into Visa’s deals with banks and the incentives it gives them

Plaid raises $425MM in series D funding round at a $13.4bn valuation

HSBC’s UK call center staff can work from home permanently post-pandemic

Economics and Markets

Robert Mundell, who inspired the Euro and tax cuts in the US, passed away aged 88. You can read his obituary by the FT on it here.

The G20 extended debt relief for the 43 low-income countries under the DSSI (debt service suspension initiative) until the end of this year

Janet Yellen and Joe Biden pitch global minimum corporation tax rate of 21% to stop companies evading tax through offshore tax havens and loopholes. His tax plan comprises of three parts: 1) Raising the US corporate tax rate to 28% from 21%, 2) Close international tax loopholes by building on the OECD’s work on “base erosion and profit shifting”, as raising tax in one country usually just incentives companies to shift profits to a tax haven with lower rates, 3) Proposing to tax large international corporations partly on the share of their sales in host markets. The Trump administration was unwilling to be a part of unless it was voluntary for companies. This would affect companies like Google and Facebook which have been very good at shifting profits to pay lower taxes. Although, Biden’s plan is ambitious, it is unlikely to be agreed upon and parts 2 and 3 will likely be impossible to enforce.

Biggest Stories of the Week

Credit Suisse ousts senior executives and Risk Chief, and cuts dividend after Archegos and Greensill collapses

Credit Suisse said it lost $4.7bn from Archegos’ collapse alone, and immediately ousted at least 7 senior executives, traders and risk managers as it handles a double scandal at once.

Lara Warner, chief risk and compliance officer and Brian Chin, head of the investment bank, are set to leave.

As a result of the $4.7bn loss, the bank suspended its SFr1.5bn share repurchase program and slashed its dividend by 2 thirds to SFr0.10 per share. Controversially, the Chairman’s total compensation for the year will go unchanged at SFr4.7MM for 2021.

Credit Suisse CEO Thomas Gottstein said perhaps the most obvious thing possible regarding the situation:

“The significant loss in our prime services business relating to the failure of a US-based hedge fund is unacceptable. In combination with the recent issues around the [Greensill] supply chain finance funds, I recognise that these cases have caused significant concern amongst all our stakeholders.”

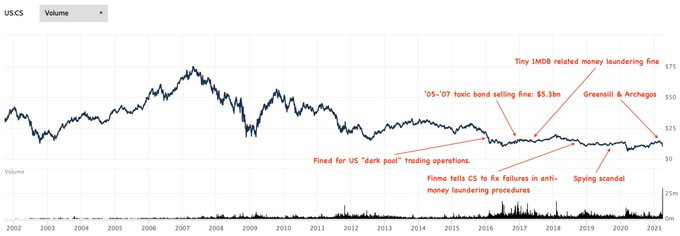

To many, this was not much of a surprise, Credit Suisse has always been well known for risk management failures, criminal activity and really it’s the epitome of what people think of as the classic European bank. Here’s a chart of CS’ stock price that I annotated showing some of their mishaps over the past 5 years:

SEC review finds some investment managers potentially mislead investors over ESG practices in their funds

The SEC said it found some investment firms that claim to be investing in a socially responsible manor were potentially misleading investors. A review of some funds found that their claims to support environmentally friendly policies don’t actually add up to what they actually are doing.

Those funds market themselves as investing in a strategy called ESG investing - where they address environmental, social and governance issues from climate change to corporate diversity in their investment strategy.

The SEC didn’t disclose what those funds were, or how many were involved, but I can tell you it’s probably a lot more widespread that just a few funds. I looked at one of iShares (owned by Blackrock)’ $16.5bn so-called “ESG” fund and these are the top companies being held in the fund (source: their website):

I might be wrong, but these don’t look particularly “ESG” to me. For the most part all of these passive funds mainly just own S&P 500 companies, and that’s about it. You can scroll through the pages and it looks like nearly all passive ETFs, you wouldn’t think this was an “ESG” fund if I just showed you the holdings.

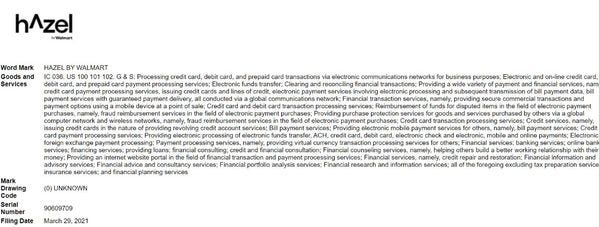

Walmart files for trademark for ‘Hazel by Walmart’, its Fintech unit

On March 29, Walmart filed this patent with the U.S. Patent and Trademark Office, giving potential clues into what Walmart’s plans are for their fintech.

It could potentially offer credit cards, financial-portfolio analysis and consulting, payments processing and more. Walmart never gave a name for its fintech venture but the name and logo shows “Hazel by Walmart” which could be its name.

JPMorgan reaches deal with Instacart for their new credit cards, Doordash may be next

JPMorgan will issue credit cards launched by Instacart, and potentially even Doordash in the coming future.

The grocery delivery company, Instacart chose JPMorgan Chase to issue a credit card that will reward its loyal and frequent users - according to Blooomberg, the WSJ and American Banker. Doordash, which is a delivery takeout company, is also planning to launch its own rewards credit card, and has received offers from more than 10 large banks to issue it.

Instacart and Doordash both benefited from the surge in online spending and food delivery last year. They expect the demand surge to be sustained in the future, even as we come out of the pandemic. For banks, this gives them to opportunity to diversify away from the lucrative travel credit card rewards business.

JPMorgan is also partnered with other large brands, such as Amazon and Starbucks, as well as a number of airlines and hotel companies. This will be a new area for them.

Instacart is not expected to launch its credit card until next year, and card holders will likely earn 5% cash back on their Instacart purchases.

UK insurance broker Ardonagh launches asset management unit

Ardonagh, one of the UK’s largest private insurance brokers launched an asset management arm (Ardonagh Global Partners) as it plans to build on its buy-and-build strategy after its £2bn refinancing last year.

It has announced its first acquisition already: AcuRisk, a Chicago based healthcare insurance specialist, and is a joint venture with Amynta Group.

David Ross, the CEO said:

“What we are effectively doing is setting ourselves up almost as a private equity investor. We are a link in the chain between a really substantial, entrepreneurially driven business and traditional capital.”

They plan to spend as much as £1bn on acquisitions over the next three to four years.

They also have no plans to go public, and are fully able to access capital without an IPO. Ross said that the short-term thinking of quarterly earnings and the “distraction” of catering to public shareholders during the Covid-19 pandemic as reasons for staying private. “I don’t think our top team will think going public is necessary or desirable.”

Some other stuff

Key points from Jamie Dimon’s 2020 letter to shareholders:

He’s very bullish on the US economy expecting a strong recovery that “could easily run into 2023,":

“I have little doubt that with excess savings, new stimulus savings, huge deficit spending, more [quantitative easing], a new potential infrastructure bill, a successful vaccine and euphoria around the end of the pandemic, the U.S. economy will likely boom,”

Big tech and fintechs pose serious competition to banks. He said that competition from big tech companies like Amazon, Apple, Facebook, Google and Walmart, as well as fintechs is “here to stay” and banks must get more aggressive to handle the threat - He wrote:

“While I am still confident that JPMorgan Chase can grow and earn a good return for its shareholders, the competition will be intense, and we must get faster and be more creative,”

Work from home is not here to stay, and a majority of JPMorgan employees will be returning to the office, and “a small percentage of employees, maybe 10%, will possibly be working full-time from home for very specific roles,”

Banks’ regulatory capital rules and requirements prevented JPMorgan from doing more to support the economy during the early days of the pandemic. He particularly focused on the US Treasury market which was under pressure from immense selling in March and capital requirements prevented large banks like JPMorgan from absorbing the sell-off in Treasurys because they had to maintain higher amounts of capital reserves against their Treasury holdings.

“One day, someone is going to ask why the banking system has $4 trillion either in the form of cash or deposits at the Fed or Treasury securities. Shouldn’t we use some of this liquidity to help the economy? It’s a good question, and I’ve yet to see agreement on the right answer.”

Jamie Dimon called for regulators to ‘level the playing field’ between banks and shadow banks/fintechs in terms of how products and services are treated. He highlighted the differences in regulation in this chart:

“While some of this may have been deliberate, sometimes the rules were accidentally calibrated to move risk in an unintended way. We should remember that the quantum of risk may not have changed – it just got moved to a less-regulated environment “

Next week, big banks are reporting earnings, here’s the schedule:

Wednesday: JPMorgan Chase & Co., Goldman Sachs and Wells Fargo

Thursday: Bank of America and Citigroup

Friday: Morgan Stanley

What We’re Reading:

Bloomberg: SPACs and Crypto Are Mystery Boxes, Not Always in a Good Way

NYT: Beyond Pandemic’s Upheaval, a Racial Wealth Gap Endures

Barron’s: Bitcoin Is Making a Splash. Is It Safe for Investors to Test the Waters? (I’m not personally a fan of BTC, but this is an interesting read)

Institutional Investor: Hedge Funds Just Had Their Best Start to a Year in Decades

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. I/we may, directly or indirectly, have positions in securities mentioned on this site. I am (/we are) not registered as financial, or investment advisors, or securities broker-dealers with the SEC, FINRA, or any other securities regulatory body. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and their opinion, and do not represent the opinion of those associated with the writer. Use the materials and information presented on this site, and newsletter at your own risk. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.