Storms, Paypal, Morgan Stanley and Lawsuits

Paypal, Morningstar and the SEC, Morgan Stanley, Berkshire Hathaway and more

Glad to say that it was a much more interesting week this week.

If you haven’t already, please do subscribe for our weekly newsletter.

Follow us on Twitter: @banking_journal

The Week’s Briefing:

M&A

Athene ‘expresses interest’ in purchasing 19.9% stake in AIG's life & retirement unit; AIG is actively looking to sell

Progressive acquires Protective Insurance Corporation for $338mm (all cash)

Banking, Insurance & Regulation

Wells Fargo wins Fed’s approval for governance overhaul - according to sources - a major step towards getting released from the bank’s asset cap imposed by the Fed

Citi looks into divesting foreign consumer units under incoming CEO, Jane Fraser, in an attempt to slim down the bank

Mark Carney joins Stripe’s board, just at the edge of a new funding round

Morgan Stanley forms Global Capital Markets’ head in Germany after no financial services Brexit deal between EU and UK.

U.S. insurers brace for high Texas storm claims

Citigroup loses bid to recover $500mm accidentally transferred to wrong accounts

Apollo names ex-SEC Chairman Jay Clayton as lead independent director

Morningstar sued by SEC over CMBS ratings

NatWest bank exits Ireland

Barclays resumes dividend and payouts; boosts investment bank bonus pool by 6%

LME brokers plan to set up divisions in the EU as a result of Brexit

Berkshire exits JPMorgan position, sells down more Wells Fargo, dumps PNC and M&T

Fed warns on potential commercial real estate loan defaults

Insurance & Bank Earnings

Barclays’ Q4 profit fell to £220mm from £681mm a year earlier; Q4 revenues fell 7% to £4.9bn; FY 2020 profits dropped 38% to £1.5

AIG’s profits fell 10% YoY in Q4 after mark-to-market adjustments in hedging programs for certain products sold by its life-insurance unit; Q4 net-loss of $60mm, down from a profit of $992mm in 2019, AIG’s “adjusted after-tax income” declined 10% to $827 million

Allianz profits fall 14% YoY to €6.8bn

Credit Suisse swings to Q4 loss of $393m, despite strong investment banking gains, after litigation and coronavirus-related credit writedowns weighed on the bank’s earnings; FY 2020 net income fell 23% YoY to SFr2.7bn; revenues were flat

NatWest reports FY 2020 losses of £351mm

Economics & Markets

US adjusted-retail sales (ex-auto) rose 5.9% in January; led by building materials, up 19% and online shopping up 28.7%

US big-bank Fed-backed MBS holdings reach record high of 15.8% of combined assets at the largest 25 banks

Total assets at the largest 25 US banks fell by 0.3% to $20.6 trillion

Japan’s economy grew 12.7% in Q4; GDP still fell 4.8% for 2020

British Pound Sterling reaches strongest level against the USD in 3 years

General Market & Economic Observations

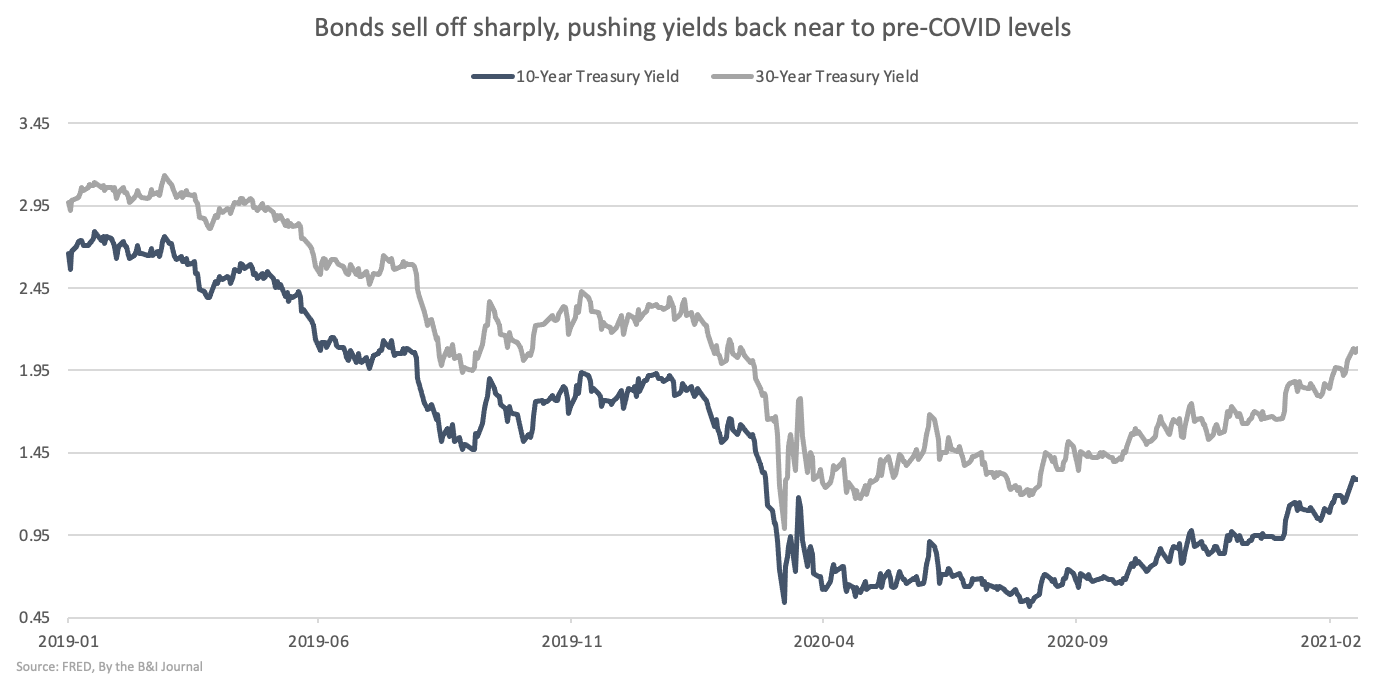

U.S. 30 year treasury yield breaks 2% for the first time since March; 10 year treasuries continue to sell off

US Housing starts fall to 1.58 million; permits rise to 1.881 million

Initial jobless claims rise unexpectedly to 861k from 848k a week earlier

US adjusted retail sales rose 5.9% after latest stimulus package was passed

American borrow record $1.2 trillion in mortgages, led by those with the highest credit scores, on the back of record low mortgage rates as the Fed continues aggressive asset purchase program

Biggest stories of the week:

Fed warns on potential commercial real estate loan defaults

In a report published on Friday, the Federal Reserve warned of significant risks of business bankruptcies and a steep drop in CRE (commercial real estate) prices.

“Business leverage now stands near historical highs. Insolvency risks at small and medium-sized firms, as well as at some large firms, remain considerable.”

This comes after the FED and the government encouraged struggling businesses to take out debt, at ultra-low rates, to help them survive the COVID-19 crisis.

Not only could CRE prices suffer from a deep recession and bankruptcies rising, but a longer term trend may stick post-COVID, where more people work from home and businesses cut back on spending, leading to CRE demand falling, and online purchases pick up, forcing brick-and-mortar retailers to shutter and malls being left empty.

This could all lead to a sharp decline in CRE prices, not only in the short term, but in the long term as well.

Morningstar sued by SEC over CMBS ratings

According to a lawsuit filed by the SEC on Tuesday, Morningstar Inc. allowed credit-rating analysts to adjust financial models that resulted in better terms for bond issuers and, in some cases, less interest income for investors.

Those undisclosed adjustments were made to 30 commercial mortgage-backed securities (CMBS) valued at $30bn. The SEC says the changes were material to investors, and should have been disclosed.

In 2019, Morningstar bought DBRS Inc. for $669mm in a bid to become a larger playing in the bond-rating business.

In May 2020, Morningstar paid $3.5 million to settle an un-related SEC investigation that alleged a former credit-ratings division broke conflict of interest rules

Morningstar said in a statement regarding the investigation that it broke no laws or rules:

“The SEC overstepped its regulatory limitations by imposing requirements that would regulate the substance of credit-rating methodologies,

Morningstar prides itself on the integrity and independence of its research and analysis. Morningstar will continue to be motivated by the objective of bringing clarity and diverse opinions to the market.”

Post-2008 major reform came to the bond-rating industry, which has an inherent conflict of interest given that they are paid by issuers to rate bonds, meaning issuers shop around for the best ratings, affecting the outcome, and hiring whatever firm gives the highest rating.

The undisclosed adjustments were “overwhelmingly used to ease those stresses, which lowered expected losses for many classes” of bonds that were rated by Morningstar. The lower losses were used to assign higher ratings to at least 100 classes of bonds, which benefited the issuers that hired Morningstar to assign the grades, the SEC claimed in its suit.

Morningstar’s stock fell nearly 4% on the news, before quickly recovering back to where it was before.

Citi looks into divesting foreign consumer units

Citigroup is looking into divesting certain units across its retail banking division in the APAC region, including those in South Korea, Thailand, the Philippines and Australia, according to the sources.

No decisions have been made, divestitures could be spaced out over time, and Citi may even, in the end, decide to keep all its existing international operations, said those private sources first reported on by Bloomberg.

In a statement released by the bank, they said:

“As our incoming CEO Jane Fraser said in January, we are undertaking a dispassionate and thorough review of our strategy, including our mix of businesses and how they fit together,

As you would expect, many different options are being considered and we will take the right amount of time before making any decisions.”

Citi shares rose 3.6% on the news.

After Citigroup was bailed out in 2008, it has been struggling to grow, and its profits have been weak. The current CEO since 2012 is Michael Corbat, who announced he was retiring last year. Over his tenure, the stock has been flat, and vastly underperformed the market and peers such as JPMorgan and Bank of America. Incoming CEO, Jane Fraser is looking to turn the bank around, into a slimmer, much more profitable organization with much better corporate governance and internal controls, which had been criticized by the OCC and the Federal Reserve last year.

Berkshire exits JPMorgan, sells down more Wells Fargo, dumps PNC and M&T

In Berkshire’s 13F released this week, Berkshire had exited and trimmed down a number of their bank positions, after exiting Goldman earlier on in the year.

Among those changes was a JPMorgan position exit, which had been sold off almost entirely the previous quarter, and selling PNC Financial Services Group as well as M&T Bank. Berkshire also continued to slim down its Wells Fargo position.

Berkshire instead deployed that capital into Chevron, AbbVie, Merck and Bristol Myers Squibb, as well as adding to some smaller positions, such as RH (Restoration Hardware).

In 2020, Berkshire was a net-seller of equities, net-selling over $9 billion of stocks in 2020, many at a loss or at the market lows.

Morgan Stanley forms Global Capital Markets’ head in Germany

After no financial services Brexit deal was reached between the EU and the UK, Morgan Stanley named former London-based, Martin Luehrs as head of Global Capital Markets at their Frankfurt subsidiary, a new role that shows the investment bank’s strategy to shift more business to continental Europe from London post-Brexit.

Morgan Stanley had already moved staff from London to the EU, and it started a trading venue in Paris in 2018. The investment bank plans to move about $120 billion of assets to Frankfurt, most of which were expected to be transferred in the first quarter of this year (according to Bloomberg reports).

Morgan Stanley is not the only bank to move staff and assets to the EU, banks such as JPMorgan and Goldman Sachs relocated a number of staff and assets last year as a result of the no-Brexit deal.

International banks have already said they will move $1.2 trillion of assets to the EU, and will likely continue to do so in the future, over time.

Without an equivalence deal, UK-based banks have to sell securities to European clients from a European office. Impacting a range of assets, from equities to bonds to collateralized debt obligations and swaps.

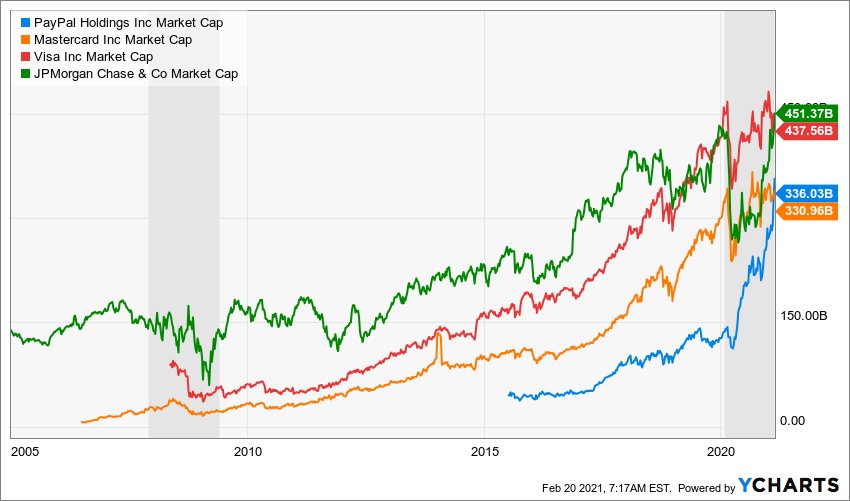

PayPal overtakes Mastercard in market cap.

After reporting strong 2020 earnings and growth, PayPal’s stock rallied, leading the firm to now be worth more than Mastercard.

U.S. insurers brace for high Texas storm claims

US property and casualty (P&C) insurers are bracing for claims for property damage in Texas after the storm. Claims for things like collapsing roofs, bursting pipes and lost business after the storm crippled the state’s energy grid last week.

Moody’s estimated the insurance losses could be as much as billions of dollars in Texas, the second largest P&C insurance market in the US.

Storms in Texas happen very often, but nothing like what happened last week often occurs, where the storm took a hold of the whole state and crippled the energy grid, sending energy prices sky-rocketing and supply/production almost collapsing.

Insurers don’t often expect a hurricane to hit the whole state of Texas, and they are expecting hundreds of thousands of claims as the crisis eases.

The largest homeowners insurer in Texas, State Farm, said they had already received “thousands” of claims this week for frozen-pipe damage compared with just 75 in Texas during 2020, said the company’s spokesman, Chris Pilcic.

The 10 largest property and casualty - homeowner - insurance companies (by premiums written, in order) in Texas are:

State Farm

Allstate Corp.

USAA Insurance Group

Farmers Insurance Group

Liberty Mutual

Travelers Companies Inc.

Texas Farm Bureau

Nationwide Mutual Group

Progressive

Chubb

What we’re reading:

Bloomberg: “Summers Says Fed May Be Forced to Raise Interest Rates Next Year”

FT: “The dangers of today’s low-yielding, high-yield market”

WSJ: “Fed's Rosengren Says Vaccines Make Robust Second-Half Recovery Possible”

NYT: “A Fed president predicts the Bitcoin boom won’t last.”

Bloomberg: “Bubble Warnings Go Unheeded as Everyone Is a Buyer in Stocks”

Bloomberg: “Fretting About Inflation May Be Just the Cure We Need”

WSJ: “Companies Aren’t Saving Their Pennies as Markets Turn Bubbly”

Bloomberg: “The World Is Short of Computer Chips. Here’s Why”

NYT: “Private Equity Firms Are Piling On Debt to Pay Dividends”

Bloomberg: “Another EV Company, Another Market Obsession”

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. I/we may, directly or indirectly, have positions in securities mentioned on this site. I am (/we are) not registered as financial, or investment advisors, or securities broker-dealers with the SEC, FINRA, or any other securities regulatory body. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and their opinion, and do not represent the opinion of those associated with the writer. Use the materials and information presented on this site, and newsletter at your own risk. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.