Aviva sells Polish insurance unit to Allianz, and the EU-UK reach the first financial services trade deal

Also: WeWork, the USD, Caesars, buybacks and Wells Fargo

Follow us on Twitter @banking_journal

The Week’s Briefing

M&A

Aviva sells Polish insurance unit to Allianz for €2.5bn

Wells Fargo sells trust unit to Computershare for $750mm

Hong Kong’s Bank of East Asia sells its insurance business to AIA Group

Hartford rejects Chubb’s takeover offer

Banking, Insurance and Regulation

UK and EU reach first post-Brexit financial-services deal

Casino and hotel operator, Caesars sues its insurers to cover $2+bn of pandemic-related losses

Fed lifts restriction on US banks’ share repurchases and dividends from June 30

SEC requests banks for more information over their business with SPACs

British bank Nationwide allows all office-based employees to “work anywhere”

UK’s insurance firms pay out £470MM in Covid-related SME business claims after Supreme court judgement rules against them

Leon Black resigns from all leadership positions at Apollo

Morningstar rolls out robots to write investment reports for thousands of its smaller mutual funds and ETFs

DOJ’s antitrust regulators reviews UnitedHealth Group’s $8bn takeover of Change Healthcare

Golub Capital cuts cash payouts to Dyal Capital as $12.5bn SPAC deal merger dispute escalates

Economics and Markets

Bank of England warns banks against pulling support on Covid-related lending, saying it’s in the industry’s “collective interest” to extend loans after Government schemes end in a few days.

The Fed brushes of rise in rates as investors continue to price in a rate hike (likely too early)

US Durable Goods Orders fall for the first time since early last year

Initial jobless claims fall to 684,000, the lowest level since the pandemic began

Turkish Lira collapses as Erdogan dismisses central bank chief and hikes rates, 4 months after he was appointed, which had previously calmed investors and allowed the currency to slightly recover (you can see this at the low point in November 2020 on the chart below)

Biggest Stories of the Week

UK and EU reach first post-Brexit financial-services deal

The UK Treasury said in a statement that Britain and the EU have agreed a memorandum of understanding on financial services. The deal has been finalized and they are now working on the formal process to validate it.

The deal will help UK-based financial institutions to get back access to the single market they lost when the UK formally left the EU.

Bloomberg summarized the deal in an article as:

The memorandum sets out a framework for regulatory cooperation and a joint forum for discussing rules and procedures as well as the sharing of information. It is separate from any decision on equivalence, a series of unilateral rulings that each side can make that offer market access to financial services.

The GBP rose nearly 1% on the news.

Since the UK had left the EU officially at the start of this year, banks and financial institutions have found it difficult operating in the EU from London, which caused them to move billions of dollars into EU entities, as well as large amounts of staff.

Is spoke about this a few weeks ago, here.

The reason for that was because the EU-UK trade deal basically excluded the financial services sector, which essentially left without a deal, and more importantly without “equivalence”.

This MOU deal is not the same as an “equivalence” deal, but its’s a start and a step in the right direction.

Caesars sues its insurers to cover $2+bn of pandemic-related losses

Caesars Entertainment Inc. sued a number of its insurance carriers on the basis that they declined to cover estimated losses of $2bn as a result of the pandemic.

In the lawsuit, Caesars says that it had purchased insurance to cover its properties, to protecting against “all risk of physical loss or damage” and resulting business interruption - they said that the policies did not exclude damages and losses caused by a virus or pandemic.

One of the insurers the suit was filed against was Allianz SE which said:

“We will certainly honor Covid-19-related claims where they are part of our policies and cover is clear, however, many businesses will not have purchased cover that will enable them to claim on their insurance for Covid-19 pandemic losses.”

Other insurers in the suit are a number of underwriters at Lloyd’s of London, as well as Chubb, Markel and Aspen Insurance Holdings

Caesers paid $25 million in premiums to get an all-risk policy portfolio providing more than $3.4bn in coverage limits. Last year, Caesers lost almost $2 billion.

Fed lifts restriction on US banks’ share repurchases and dividends from June 30

The Federal Reserve said it will lift its restrictions on share repurchases and dividend payments for US banks that pass their stress tests, after June 30.

The restrictions were imposed early on in the pandemic when the economic outlook was uncertain. Since then, many of the largest US banks have accumulated a huge cash pile as they could not return capital to shareholder through most of last year, and loan loss reserves went mostly untouched.

The largest US commercial and investment banks such as JPMorgan, Goldman Sachs and Morgan Stanley saw their profits rise significantly last year as their trading desks and investment banking division made large sums of money.

The restrictions will only be lifted for banks that remained “above all of its minimum risk-based capital requirements in this year's stress test”. If a bank does not pass, the restrictions would remain in place for another 3 months.

The lifting of restrictions allows banks to raise dividends and launch new share buyback programs, which were put on halt for about a year now.

Wells Fargo sells trust unit to Computershare for $750mm

Wells Fargo sold its corporate trust business to Australian firm, Computershare for $750mm as part of a broader plan to simply and streamline operations after the bank came under scrutiny for a huge scandal 5 years ago.

The corporate trust unit’s 2000 employees will transfer to Computershare when the transaction closes later this year.

Since Charlie Scharf took over Wells Fargo, he has disposed of a number of Wells Fargo’s non-essential units to streamline the company, cut costs and boost profitably and recover from a number of scandals.

Last year, they sold their $603bn asset management unit to private equity firms, and also offloaded their $10bn private student-loan book.

David Marks, the head of Wells Fargo Commercial Capital said:

“This transaction is consistent with Wells Fargo’s strategy of focusing on businesses that are core to our consumer and corporate clients,”

Aviva sells Polish insurance unit to Allianz for €2.5bn

London based insurance firm, Aviva sold its Polish unit to Allianz for €2.5bn, and is expected to be the end of the CEO’s efforts to streamline the company, who started last July.

Since she started at Aviva, Amanda Blanc has sold a number of units across Europe and Asia in an effort to refocus on its three core markets: UK, Ireland and Canada.

The sale of those 8 non-core businesses generated £7.5bn in cash proceeds, which will be returned to shareholders and used to reduce debt.

Blanc said:

“We have made significant progress with our debt reduction plan and in due course we will make a substantial return of capital to shareholders,”

The Polish unit was sold for 17x earnings, nearly double the valuation the other businesses were sold at.

Since Amanda Blanc was appointed CEO in July, Aviva shares have risen close to 50%, but remain well below its peak nearly two decades ago, and still down significantly over the past 5 years.

Some other stuff

Whilst totally off-topic, I couldn’t help but mention WeWork’s plan to go public via a SPAC merger with BowX Acquisition Corp. this week.

In 2019, WeWork was valued at $47 billion, it will now go public at a valuation of just under $9 billion, raising $1.3bn (including $800mm of proceeds from the PIPE) . They also lost over $3bn last year.

WeWork is the epitome of what I would call a market ‘bubble’ - mostly in tech valuations but mainly in investor mindset. WeWork has never turned a GAAP profit, or even an adjusted-EBITDA profit, but that hasn’t stopped them putting out a pitch deck full of fanciful projections of their estimated non-GAAP future ‘earnings’.

WeWork going public is the bringing together of two bubbles: a tech valuation bubble, and the SPAC bubble - perfectly describing the market’s current state.

One of the great things about SPACs is that the company going public can put out whatever fanciful, imaginary nonsense projections they like, which they would never be allowed to do in a normal IPO S-1 filing. This is due to it basically being a sort of loophole and less regulated than the normal IPO procedure, as technically the company is just merging with an already public company.

Funnily enough, WeWork is no stranger to fanciful nonsense earnings projections, they are well-known for putting out pitch decks with “community-adjusted EBITDA” in their earnings presentations.

Jerome Powell had some interesting comments on cryptocurrencies, he said on Monday:

“They’re highly volatile and therefore not really useful stores of value and they’re not backed by anything,”

It’s more a speculative asset that’s essentially a substitute for gold rather than for the dollar.”

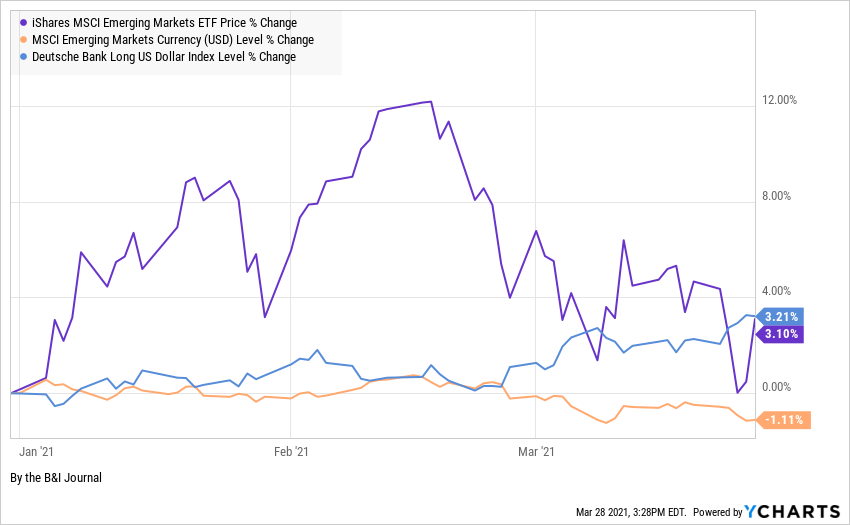

Interestingly, there are a lot of US Dollar doomsday sayers out there, but the USD has defied those calls of its demise and is now strengthening, putting an end to a huge emerging market equity and currency rally at the start of the year.

The US Dollar is not going to collapse any time soon, there are simply no suitable alternatives, and quite frankly anyone who thinks that the USD is just wrong. The USD collapse story is mostly just used by for example crypto-bulls to help inflate or “pump” the useless ‘currencies’. Ray Dalio can say “cash is trash” but, and I’m not saying he is wrong, but he has been wrong about that call and other similar calls for a long time.

What we’re reading:

NYT: Fear of Inflation Finds a Foothold in the Bond Market

FT: New Suez crisis: a global economy creaking under the strain

Bloomberg: What the Fed Should Do About Banks’ Capital Problem

WSJ: Goldman Heads to the Supreme Court

NYT: Greensill Capital: The Collapse of a Company Built on Debt

FT: Citadel’s Griffin warns of inflation risk to markets enjoying retail trading boom

Bloomberg: Wall Street: The Many Misconceptions About the Bull Market

WSJ: The Trade Pact Waiting to Happen

NYT: The Bull Market Is One. Can It Last?

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. I/we may, directly or indirectly, have positions in securities mentioned on this site. I am (/we are) not registered as financial, or investment advisors, or securities broker-dealers with the SEC, FINRA, or any other securities regulatory body. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and their opinion, and do not represent the opinion of those associated with the writer. Use the materials and information presented on this site, and newsletter at your own risk. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.