Chubb bids to take over Hartford in $24bn deal

Also: the FED, Visa is investigated by the DOJ (again), HSBC, JPMorgan, Natwest and Credit Suisse

Follow us on Twitter @banking_journal

The Week’s Briefing

M&A

Chubb offers to buy Hartford for $24bn

JPMorgan buys $410MM stake in Chinese bank’s wealth management unit

Sumitomo in talks to buy ABN Amro’s commodity loan book

HSBC looks to sell its French retail bank to Cerebus

Banking, Insurance and Regulation

FCA charges and fines 60% state-owned Natwest on money laundering charges

Federal Reserve will not extend SLR rule, and will allow it to expire as planned on March 31

DOJ investigates Visa over anti-competitive debit card practices - stock falls 6%

British government sells £1.1bn of Natwest shares bringing ownership stake just below 60%

Visa looks to raise fees in UK after EU-cap no longer applies post-Brexit

Credit Suisse restructures asset management unit after Greensill scandal; splitting units, suspending bonuses and warned of litigation from Greensill-linked funds

FCA investigates UK’s largest specialist subprime lender Provident Financial

Freddie Mac appoints Mark Grier as its interim CEO

Economics and Markets

BOE upgrades UK economy outlook, expects no medium-term inflation risks and keeps interest rates at 0.1%

The FED expects US economy to expand 6.5% this year, however signals no rate hikes till 2024

Economic outlook for the EU worsens due to severe failures in vaccine rollout, rising cases and new lockdowns

The Bank of Japan opts to no longer buy an average of ¥6tn a year in equities and launched a new scheme to subsidise bank profits to relieve effects of negative interest rates.

Financial stocks fall as FED decides not to extend SLR exemption and yields reverse

Biggest Stories of the Week

Chubb offers to buy Hartford for $24bn

Chubb, the largest non-life insurer in the US by market cap offered to buy Hartford Insurance Services Group with an unsolicited $23.2bn offer.

Chubb, led by former AIG CEO’s son Evan Greenberg offered $65 per share for Hartford in a mostly cash and stock deal.

According to people familiar with the matter (reported on by the FT and Bloomberg), Hartford’s board was unimpressed with the offer, there are no active talks between them and they are unsure whether a deal could even be reached due to significant regulatory risks.

Chubb’s stock fell 9% on the news, and key competitor The Travelers Companies’ stock fell 5% on the news.

Evan Greenberg is the son of Maurice Greenberg, who turned AIG into a financial giant pre-GFC, and his son, Evan, looks to be doing the same with Chubb. In 2015 he led Chubb and Ace to merge in a $30bn deal, and this would be the second of those mega deals.

Acquiring Hartford would allow Chubb to expand into further P&C insurance sectors including home, auto, small-business, and employee benefits insurance.

DOJ investigates Visa over anti-competitive debit card practices - WSJ

The DOJ is investigating in a new probe whether Visa is engaging in anticompetitive practices in its near-monopoly in the debit-card market- a core part of its business.

They are asking asking whether Visa limited the ability of merchants to route debit-card transactions over card networks that are cheaper than Visa.

Visa’s stock fell 6% on the news, Mastercard fell 2%

FCA launches criminal proceedings against Natwest on money laundering charges

The FCA has lunched criminal proceedings against the UK 60% state-owned bank Natwest for failing to comply with anti-money laundering regulations.

Natwest faces an unlimited fine for these charges as the FCA alleges they failed to monitor the actions of a gold dealer that deposited £365MM in its Natwest account in a series of deposits over 5 years. This gold dealer was called by a judge as “an extremely sophisticated” money laundering operation.

Natwest was bailed out in 2008 by the British government who assumed a very large ownership stake in the bank in return. This makes the case particular odd and unusual, as technically the money is going from one part of the government (the Treasury through its stake in Natwest) to another part of the same government (the FCA).

Though, the severity of the charges brought against Natwest is likely going to be something that will prompt banks to ensure that their anti-money laundering systems are 100% at all times, due to the unlimited fine under the law, which has never been used before this Natwest case.

Natwest shares fell 3% on the news.

Credit Suisse restructures asset management unit after Greensill scandal

In light of the collapse of Greensill and CS’ now frozen $10bn fund linked to them, which is facing a wave of defaults, Credit Suisse demoted one of its top executives and withheld bonuses for a number of bankers, and split its asset management unit from its more valuable weal management unit.

Of the now frozen Greensill funds, Credit Suisse has returned $3.1bn to investors- most of which were UHNW clients, no retail investors - and has another $1.25bn of cash available across the funds.

The funds were sold by Credit Suisse to inventors as short-term debt, which they got from Greensill, and an alternative to cash. They even rated the fund as the safest on a scale of 1-7.

Visa looks to raise fees in UK after EU-cap no longer applies post-Brexit

Visa is expected to raise fees in the UK as they are no longer held back by a cap imposed by the EU. According to FT sources, they will raise “interchange” fees on cross-border transactions between the EU and the UK, in October. These fees are a levy charged on behalf of banks for every debit or credit transaction on its network.

Cross-border transactions are among Visa’s most profitable businesses where it has higher margins.

Visa is expected to raise its current 0.3% credit card transaction fee - on payments made over the phone and online between the UK and EU - to 1.5%. They are also expected to raise their current 0.2% debit card transaction fee yo 1.15%.

To get around this fee, companies are increasingly looking to set up entities within the EU in places such as France or Germany, but this is unaffordable for many small businesses, who will likely be affected by this the most.

Federal Reserve decides not to extend SLR rule, and will let it expire as planned on March 31

Last year, in a bid to provide liquidity to financial markets the FED exempted banks from a requirement called the the SLR (which we discussed a few weeks ago here):

Last year, the Fed allowed banks subject to the SLR to exclude U.S. Treasury securities and deposits at Federal Reserve banks from the measure, which measures capital relative to assets. The exemptions are set to expire on March 31, but the Fed could still delay that, and has not yet come to a conclusion. The exemptions were meant to free up resources for banks to make loans and other purposes.

The SLR requires banks with $250+bn in assets to have an extra cushion of high-quality capital against their total assets. The standard level is 3%, but for the larger bank holding companies, that goes up to 5%.

The temporary relief meant allowed banks to expand their balance sheets and prevent stress of the Treasury markets, but reduced the required amount of capital by $76bn.

The rule basically means that banks don’t have to hold excess capital against their treasury bond holdings- which is weird, I know, because Treasuries (especially short term bills) are essentially risk-free given the likelihood of the US defaulting on its debt being incredibly low, meaning the likelihood that banks will need equity capital to absorb losses on treasuries is basically zero.

The problem is that since 2008, politicians and policy makers have had one motive in the financial system which is that no amount of bank capital is too much. That’s wrong. The decision to not extend this already stupid rule is doing nothing to help make the financial system safer, and is only impeding banks’ ability to help grow the economy as it will hinder loan growth, putting a strong recovery at risk.

It is possible that banks will decide to sell treasuries so they don’t have to hold capital against them- putting upward pressure on yields, or that banks will have to just limit their activity in financial markets and lend less.

JPMorgan has even warned that it may have to turn away deposits without SLR relief - that says something.

The thing is here is that the SLR rule does more damage than it does good, and seems to have become more of a political show than anything else.

Some other stuff

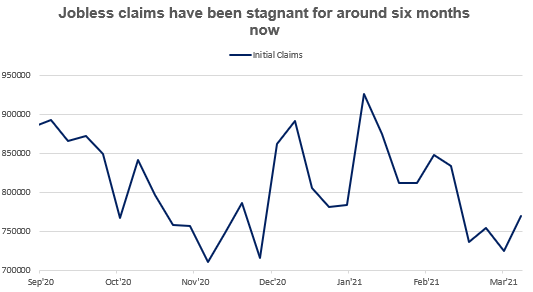

Initial jobless claims rose last week, and have been stagnant for a number of months now. The labor market is nowhere near recovering at the moment, relative to its pre-pandemic level and potential.

JPMorgan Chase consumer card spending data shows consumer spending continues to remain at low levels relative to pre-Covid, despite a number of stimulus checks between now and then, which appear to have less affect each time.

Their data also showed that restaurant spending is still very weak, although there was a notable rise in airline spending, which still remains nearly 60% below pre-pandemic levels.

What we’re reading (and listening to):

FT: Mark Carney — a chance to reboot globalisation

The Economist: More is sometimes enough - America’s banks have too much cash | Finance & economics

WSJ: As Blackstone Barrels Toward Trillion-Dollar Asset Goal, Growth Is In, Value Out

NYT: Here Are The High Costs of the Airline Bailouts

Bloomberg: Keynes's Theory of Property Risk Backed by Endowment Data

YouTube (podcast by @elite_investor): “Tail Risk Hedging, Passive Flows and the Macro ft. Mike Green with Srivatsan Prakash”

Thank you for reading!

If you enjoyed it, please subscribe, and stay tuned for next week's newsletter.

Also, do share this with others, and if you would like to contact me with any feedback, please do, at:

Email: BIJournal@outlook.com

Twitter: @oabdelmaged1

Twitter: @banking_journal

Disclaimer: This content is for informational purposes only, it does not contain or offer investment advice, and it should not be treated as such. I/we may, directly or indirectly, have positions in securities mentioned on this site. I am (/we are) not registered as financial, or investment advisors, or securities broker-dealers with the SEC, FINRA, or any other securities regulatory body. All materials and information presented on this site are believed to be true and accurate, however we cannot guarantee that they are. The materials on this site also represent the views of the writer, and their opinion, and do not represent the opinion of those associated with the writer. Use the materials and information presented on this site, and newsletter at your own risk. By reading and/or using any information and/or content/material on our site, and/or this newsletter, you accept and agree to our disclaimer.